Sleeve labels showed the highest growth at 4.0% last year, but release-liner demand

also fell on declines in pressure-sensitive label applications across Europe.

By Corey M. Reardon, president and CEO, AWA Alexander Watson Associates

Overall global demand for labels in their myriad formats grew by only 2.3% in 2022 over 2021 levels, creating a total volume of 72.617 billion sq meters, based on AWA’s most recent research. These volume numbers are spread across primarily pressure-sensitive (p-s), glue-applied, sleeve and in-mold (IML) labels, although breakthrough linerless labeling is starting to make an impact of its own against traditional, value-added primary labeling. Our annual review looks at the different technologies, geographies, current status and future trends for this diverse printing and converting field.

Asia up, Europe down

It’s not surprising that growth in labeling around the world is driven by Asia, where demand rose 4.2% in 2022 with the region accounting for a 46% global market share. While Asia remains the region with the highest overall growth opportunities moving forward, it’s important to note its current focus on pressure-sensitive, primary product labels for foods & beverages, and variable-information printing (VIP) labels for shipping and logistics.

The emerging regional markets of Africa and the Middle East grew last year by 2.9% over 2021. Overall, South American label demand experienced growth of only 1.5% in 2022 – somewhat in line with economic growth in that region.

Within established markets, Europe experienced a decline of -0.6% in 2022. This primarily was driven by a sharp decline within the European p-s label market in the last quarter (Q4-2022). The North American market experienced lower growth than last year but still showed positive overall growth of 1.6% in 2022. AWA forecasts Europe and North America to continue growing at a CAGR% of 1.8% and 2.0%, respectively, between 2022-2025.

Pressure-sensitive labels stick with it

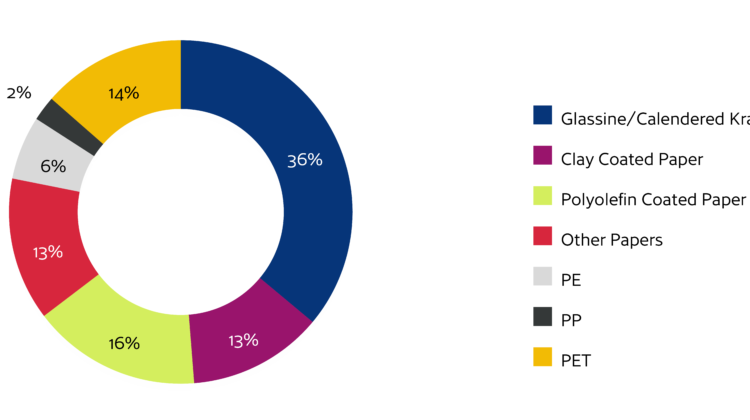

In 2022, the p-s labeling market grew significantly less – only 1.4%, down from 4.9% in 2021, and saw its share of the overall market fall to 40% (see Figure 1). Key application areas remain variable information printing, but also growing use as wine-and-spirits container decoration rather than traditional glue-applied labeling (see Figure 2). AWA predicts demand for pressure-sensitive labels will stabilize and return to their traditional GDP+ level in the coming years. The post-COVID-19 period is one like a two-edged sword: Demand for labeling of all types skyrocketed in 2020-2021 but now moderation has returned with its corresponding slower – but easier to manage – demand.

Release liner slides into new uses

Dominated by labelstock applications, release liner is a strongly developing industry base which grew at around 2% last year, in part by innovating with new end uses. Hygiene, medical, industrial, envelope, tapes, graphics-arts, food & bakery, electronics, building & construction and composites are mainstay categories for release liners. Still, from one extent to another, release-liner demand (as a vital component of p-s labeling) could see some market difficulty in the years ahead as this format continues to lose global market share.

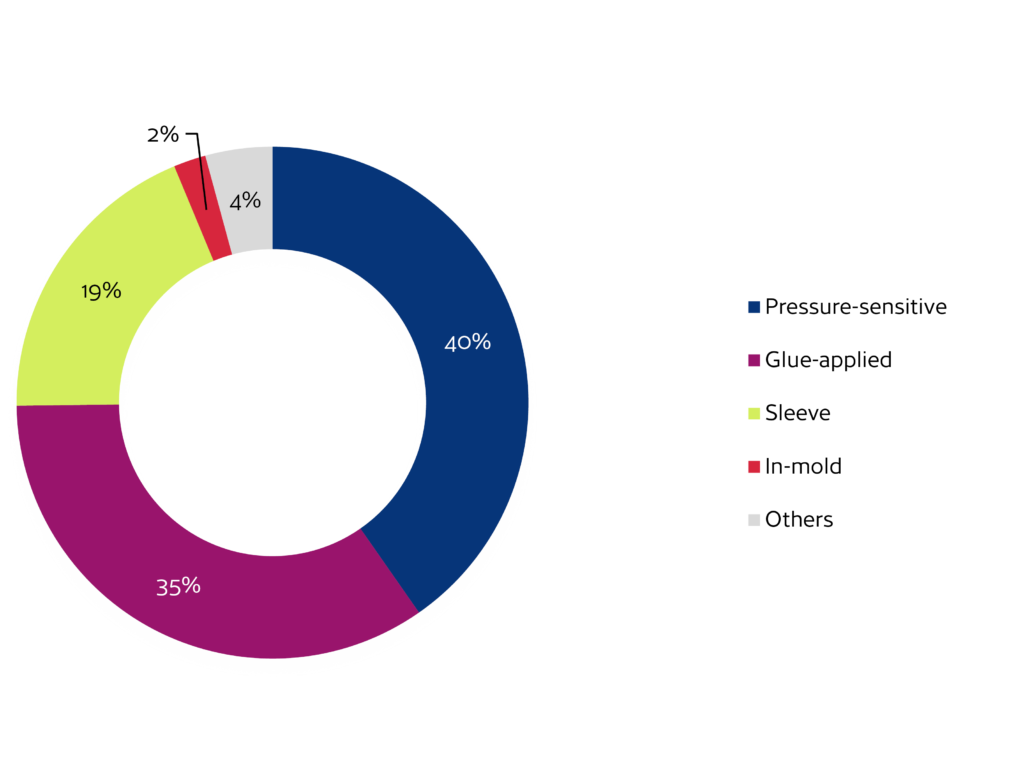

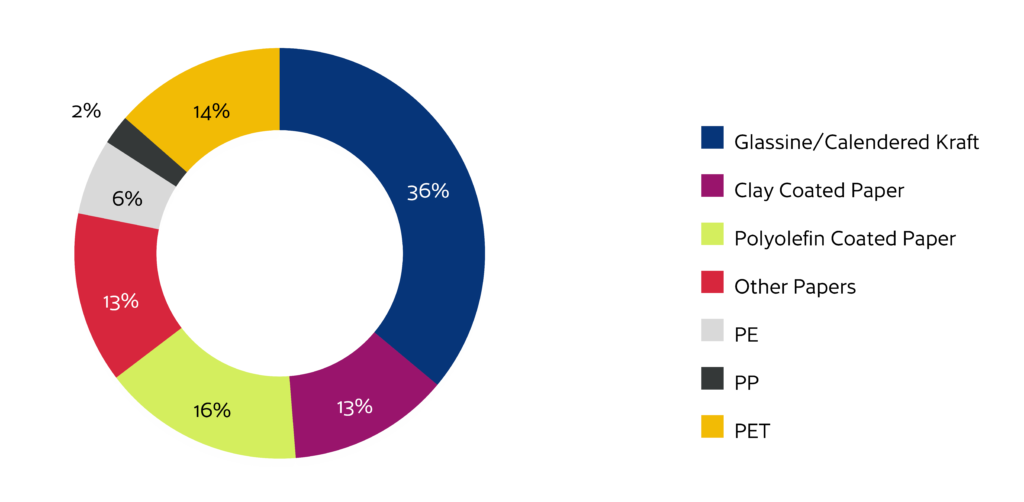

Substrates for release-liner stock remained unchanged last year from 2021. Glassine and supercalendered kraft (SCK) paper still represent the highest-volume release base materials with a joint 36% share of the global market (see Figure 3). These are followed by polyolefin-coated paper and PET film, at 16% and 14% shares, respectively. Asia gained another percentage point in 2022, now representing 41% of the global release-liner production market.

Sleeve labels are dressing up more brands

With almost one-fifth of all labeling-material volume, sleeve labels themselves offer a choice of formats – heat-shrink TD, stretch, ROSO™ MD and RFS MD sleeving. Most prevalent are heat-shrink TD sleeving with an 89% share of the global sleeve-label field. For complex container shapes, they uniquely provide the 75% shrinkage or distortion capability these bottles and cups require (see Figure 4). To simplify recycling of such plastic containers, many heat-shrink sleeve labels today are perforated (either voluntarily by the brand owner or soon to be required by law in some countries), so consumers may separate them from the container after use.

Food, beverage and household chemicals represent the highest market shares in the sleeve label market, and these three end-use segments accounted for a 90% market share in 2022. One example is the “Coppa Cocktails” line. The unusual cocktail-shaker bottle design uses shrink sleeves to align shape, graphics and product. Converter Reynders Label Printing won “Best TD Shrink Sleeve” for its work on “Coppa Cocktails” in the 2022 AWA Sleeve Label Awards (see page 14 for more information).

Heat-shrink TD sleeve volumes continue to increasingly compete with p-s labels in most markets and showed a healthy global growth rate of 4.2% in 2022. Combining this growth rate with those of the lesser stretch-sleeve and RFS/ROSO™ MD formats results in an overall global volume increase for sleeve labels last year of 4.0%.

In-mold labels are the “in” thing

As with all label formats, demand cooled for in-mold labels last year. While Europe represents the largest regional market for IMLs with a 57% global share, demand grew at only 2.1% in 2022 compared to 3.3% in 2021. Overall, IML applications showed 3.0% growth worldwide last year, with the highest percentage rates in South America and Asia.

Brand owners of spreads, ice cream, yogurts and similar high-volume consumer foods and beverages (i.e., just about anything in a tub or cup) are the main targets of IMLs, but unusual new end uses abound (think plastic buckets of paint). IMLs remain stuck at just 2% of the global market, despite the aforementioned broad field of possible applications.

In the global market, injection molding (IML-IM) is the largest application for in-mold labels. The relative proportions of different types vary from region to region with the developed European market being the hot spot for IML-IM, and North America seeing higher demand for IML-EB (extrusion blowmolded).

Who needs a liner?

With a market driven by paper shortages, cost efficiency, further development of e-commerce, new technology and sustainability, linerless labels are ready to answer the call. This format represents about 5% of the pressure-sensitive label market globally, with North America accounting for 51% of worldwide demand. VIP and primary product labels represent almost equal shares of the global linerless label field – 55% and 45%, respectively. Main applications for linerless labels are in wrap/sleeve food packaging, transportation & warehousing, and weigh-scaling (primarily at retail stores).

Numerous other changes ahead

Flexible packaging also will continue to bring change to the retail shelf, either direct-printed and thus replacing the need for a label, or in some cases with separately printed labels. Changes in the size of packaging to accommodate single-use as well as large-quantity content are an element that is adding strength to this market.

Direct-to-container print – on plastic, glass and metal containers – is a fast-developing technology which offers added options in terms of limited editioning and personalization and is an important area for digital printing. AWA research indicates that the health & beauty, personal-care and beverage sectors are the most likely end-use markets to be early adoptors for this technology.

Sustainability and recycling are top concerns today in every industry, and an increasing number of related international legislation is being directed toward labeling and packaging. Downgauging of label and packaging substrates and focusing on mono-materials as opposed to multilayer structures already are evident. Pressure-sensitive and shrink-sleeve labeling additionally are faced with concerns over waste creation at the label production and application stages.

P-s labeling’s volumes of liner and matrix – compared to the broader packaging industry – are relatively small but complex. The mixed nature of a pressure-sensitive label (clean adhesive-coated label laminate, printed/diecut laminate, matrix waste, siliconized release liner) is driving development of industry-specific recycling. Today, collection and recycling/second-life solutions, covering label converter and label application sites, are successfully functioning in many countries.

Shrink-sleeve labels are not necessarily compatible for recycling with the containers to which they are applied, but here again there is positive movement. Perforated shrink sleeves which the consumer can “unzip” after use to simplify recycling are available, and developments in fully recyclable sleeving film are coming on-stream.

Digital print technologies have introduced new possibilities – shorter print runs for brand-versioning or local-language labels, as well as for specific brand identities and personalization. To meet this broadening range of label and product-decoration options, the analog-print processes, particularly flexography, now are increasingly and successfully partnering with digital print in hybrid in-line presses.

Conclusion

What then are the growth trends for the future? Pressure-sensitive labeling’s versatility will keep the field healthy, and industry initiatives on sustainability and recycling of associated liner and matrix will continue. VIP labels certainly will be a growth driver, while primary product labeling will continue to experience competition from other labeling technologies. Developments in private-label products for retail and brand-versioning (especially for short-run label print using digital technologies), however, represent new and continued growth opportunities for primary labeling. And lastly, linerless labeling continues to advance, showing good growth prospects in the years ahead.

Corey M. Reardon, president & CEO of AWA Alexander Watson Associates (Amsterdam, Netherlands), is a graduate of the University of Cincinnati in Marketing and Strategic Planning and the Kellogg School of Management at Northwestern University in Industrial Marketing. He began his career over 40 years ago in Corporate Strategic Planning, then joined what is today Loparex in 1987, holding increasingly senior roles in various Product Management, Marketing and Business Development positions worldwide, and Director of Marketing and Sales for European operations. After Loparex, Corey then joined Avery Dennison as Marketing Director for Europe until he left to acquire AWA in 1999. He can be reached at +31-20-676-2069, email: c.reardon@awa-bv.com, www.awa-bv.com.