Trade group advocates for packaging at all state / federal levels, promotes legislation for proper labeling, EPR laws, efforts with advanced recycling.

By Alison Keane, Esq., CAE, IOM, president & CEO, Flexible Packaging Assn. (FPA)

To say that the US flexible-packaging industry is seeing healthy growth is a bit of an understatement. The total US flex-pack industry was estimated to be $42.9 billion in annual sales for 2022, an increase of 15.3% from the $37.2 billion in 2021. Our analysts at the Flexible Packaging Assn. (FPA) estimate that the flex-pack industry grew to $44.7 billion in 2023, for a growth rate of 4.2%, and forecast that the overall field will grow to $50.6 billion by 2027, for a CAGR of 3.3% from 2022-2027. And perhaps even more telling, flexible packaging now represents 21% of the total $180.3 billion US packaging industry, up another 1% from 2021, which is second only to corrugated paperboard at 22%.

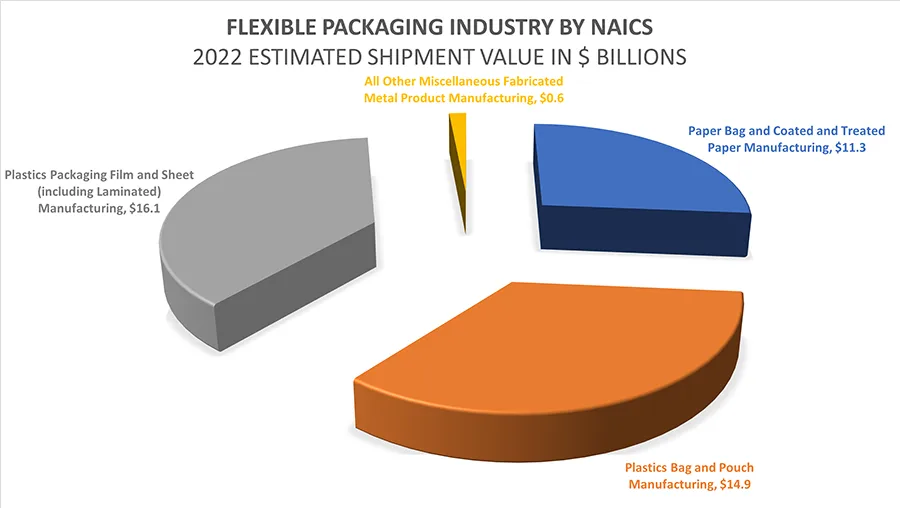

Over 85% of FPA’s members experienced higher growth in 2022 than in 2021 – with 86% expecting higher revenue in 2023. The largest category related to flexible packaging is the area of “Plastics Packaging Film and Sheet (including Laminated) Manufacturing,” which made up about $16.1 billion in 2022 (see Figure 1). This was followed closely by “Plastics Bag and Pouch Manufacturing” which generated $14.9 billion in value. The third largest category was for “Paper Bag and Coated and Treated Paper Manufacturing,” of which about $11.3 billion was attributed to flexible packaging. The final piece is related to the use of aluminum foil by the industry and makes up a much smaller segment of about $600 million.

Flex packs by components, end uses

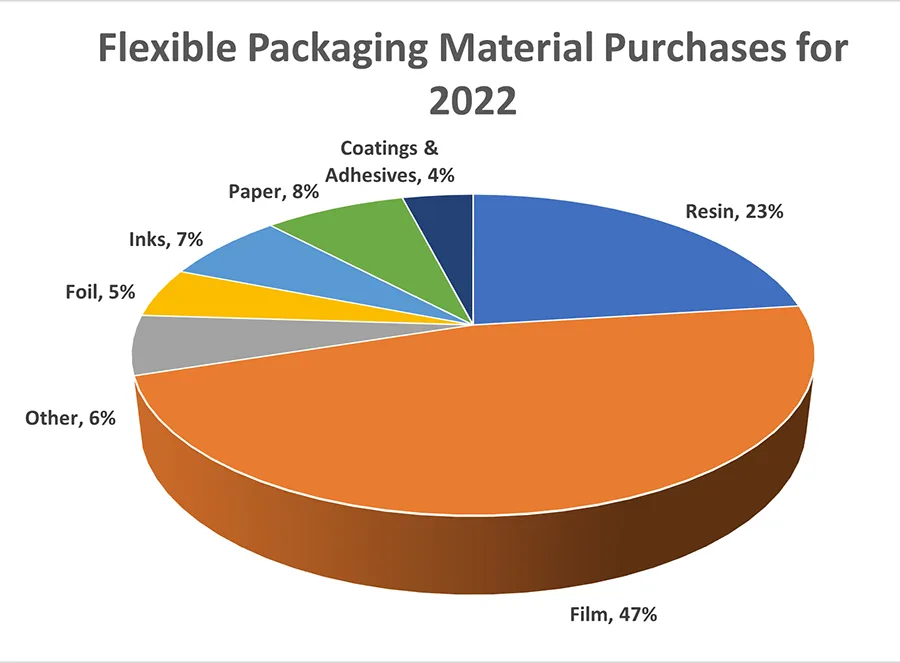

Flexible-packaging converters use several different materials and processes to manufacture their products. Plastic films and resins accounted for the largest spend for converters in 2022 with the two categories making up more than two-thirds of material purchases – films are 47%; resins are 23% (see Figure 2; note: average used for calculation). Within films, polyethylene remains the dominant material, with 96% of converters responding to our annual survey saying they use PE. Polypropylene and polyester were the next most frequently used film categories. This generally is because the industry is heavily vested in food packaging as well as health and medical-device packaging. Plastic and multi-material packaging provide the ideal barrier protection for these products.

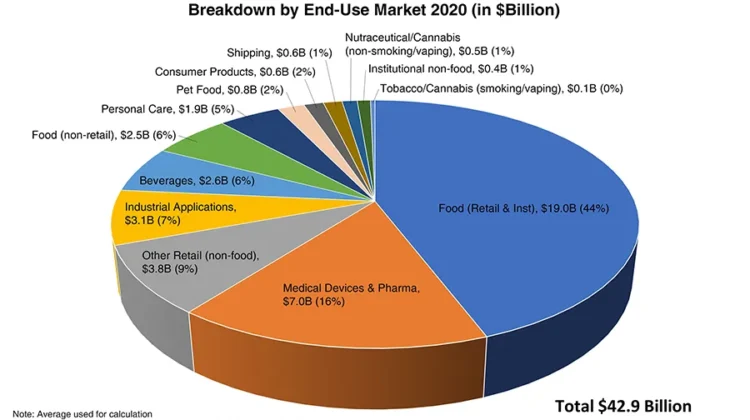

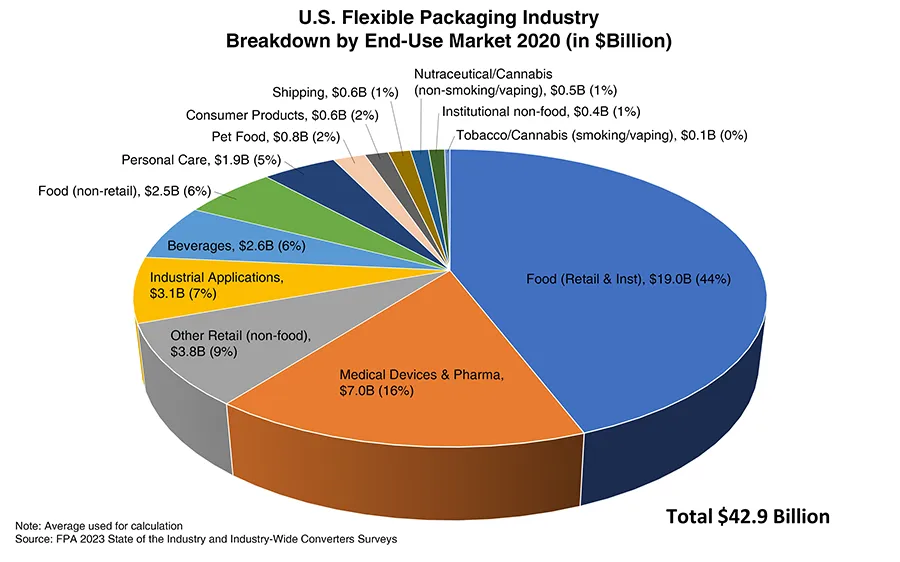

Food remains the largest end-use segment for flexible packaging. It accounted for $19.0 billion of annual sales revenue, making up about 44% of the total market in 2022 (see Figure 3; note: average used for calculation). The next largest market was in medical and pharmaceuticals, with $7.0 billion, for a market share of 16%. The other “value-added” markets, such as beverages, non-retail food and personal-care, made up a smaller percentage of the overall flexible-packaging market with 6% or less market share each. Given the highly specialized nature and use of much of flexible packaging’s portfolio, circularity solutions continue to drive the FPA’s advocacy efforts.

Advocating for packaging at all levels

2023 was yet another landmark year for packaging advocacy at the state level. While FPA was heavily engaged in several issue areas, including labeling standards, per- and polyfluoroalkyl substances (PFAS) bans and protecting advanced recycling technologies, our highest priority remained extended producer responsibility (EPR) legislation. Last year, we saw a record 43 packaging-EPR bills across 16 states; but through Herculean efforts, particularly in the states of Hawaii, Washington and New York, no new state packaging-EPR legislation passed. Instead, in one state where FPA supported the EPR legislation, Maryland, and in one state where FPA opposed the EPR legislation, Illinois, needs assessment bills were passed instead, calling for comprehensive evaluation of the respective state’s current and future recycling capabilities and needs.

This is a positive development, even in a state such as Maryland, where it was a well-crafted EPR bill, as states are realizing the complexity of packaging EPR and smartly deciding to gather more information before implementing large programs with no precedence. The four states that passed EPR legislation, Maine and Oregon in 2021 and California and Colorado in 2022, still are in the infancy stages of drafting regulations to institute such. Many states are waiting to see how these programs work in those states with laws, and full implementation of such still is several years out.

Other EPR bills took novel but deeply flawed approaches to EPR for packaging. Hawaii, for example, focused on reduction, reuse and recycling targets. The legislation set a goal of 70% reduction in the amount of packaging waste that either is landfilled or incinerated in the state by 2030. In New York, packaging EPR has been a major focal point of the Assembly and the Governor’s Office (Administration) for the last several years, and there is a growing desire to get something passed. However, there were five competing bills, all taking different approaches, which detracted from anything passing the final days of the legislative session.

Similarly, packaging EPR continues to be a major legislative priority in the state of Washington. Washington largely was considered the most likely state to pass EPR in 2023 and started with significant momentum, but the >140-page measure, which also contained a bottle deposit/return system, ultimately stalled as negotiations broke down and failed to advance. New York and Washington remain two high-priority states for FPA in 2024, and we already have seen a draft of Washington’s EPR bill for 2024 and are working on an independent, industry coalition bill for New York.

We expect to see a bill in Hawaii, but it will now be modeled after the needs assessment bills passed in 2023 instead of a full EPR program. Additionally, work will be ongoing in the EPR states as more regulations are released in Maine, Oregon, California and Colorado in 2024.

Plethora of industry-impactful laws

Other bills not directly tied to EPR that FPA focused on included advanced recycling technologies, PCR content laws, labeling bills and toxic chemical bans, specifically targeting perfluorinated substances (PFAS) in packaging. FPA was successful in defeating or improving legislation in several states, at least delaying infeasible reporting requirements or bans on the use of PFAS in flexible-plastic packaging.

Nevada’s bill was uniquely problematic. The bill included a negative labeling requirement for intentionally added PFAS in certain products and packaging. In short, covered packaging and products that do not contain intentionally added PFAS would be required to include “No Perfluoroalkyl or Polyfluoroalkyl Substances were Intentionally Added or Used to Make This Product,” in both English and Spanish, on the product’s label. This unprecedented approach would have impacted myriad products and packaging for sale in the state, a complete disruption to commerce as we know it. Despite this, the bill successfully moved through both chambers but ultimately was vetoed by the Governor upon FPA and other industry associations’ urging.

In another 11th-hour legislative win, FPA was able to push back the ban on PFAS as processing aids in food packaging in Rhode Island until 7/31/2024 from the January 1deadline. We will be back in 2024 to try to gain additional time, as Rhode Island is the only state that includes processing aids as “intentionally added” PFAS, and the industry needs additional time to find alternatives at scale and cost.

FPA also has seen an increase in the number of recyclability labeling bills introduced at the state level. These “Truth in Labeling” bills are modeled after California’s SB 343 (2021) which targets certain statements and the use of the “chasing arrows symbol” or versions of it. In 2023, FPA was successful in defeating bad labeling legislation in Connecticut, Illinois, Maryland, Nevada, New York and Oregon, and continues to monitor Massachusetts and New Jersey where (at press time) there still could potentially be movement before January.

FPA is awaiting CA SB 343’s implementation direction due January 1 to determine what changes may need to be made to flexible packaging’s labels, particularly the How2Recycle® store drop-off label for polyethylene structures by the July 2025 implementation date. California certainly will set the precedent for other states to follow.

Again, we think it vitally important that labeling for recyclability, just like nutritional information and other product communication, be uniform; labeling based on individual state standards would be devastating to commerce for products people use every day. Further, it will create only more consumer confusion about recycling as people purchase and dispose of goods across state lines.

If you want more recycling, more, and not less, harmonization is needed, and these state “one-off” bills do the opposite. In this vein, the FPA urged the US Federal Trade Commission to update its guidance on labeling for recyclability and work on draft federal legislation in this regard for future introduction.

Continued efforts in advanced recycling

Lastly, as FPA firmly believes a suite of solutions is necessary to address the lack of collection, processing and end-markets for flexible-packaging circularity, FPA advocated in several states for legislation enabling and funding advanced recycling, including chemical recycling. We were successful in several states, and 24 states now have laws on the books protecting advanced-recycling technologies.

This work continues in 2024. Particularly for food, HBA and medical packaging, advanced recycling will be necessary for any post-consumer content requirements (PCR). While such PCR requirements currently apply only to plastic bags in states such as New Jersey and Washington, FPA believes we will continue to see such bills expand, either as stand-alone proposals or through EPR bills.

2024 is an election year in many states and at the federal level, so this may dampen the focus on policy issues in some areas, however, packaging policy remains top of mind, so FPA’s advocacy in this area will remain a top priority.

Alison Keane, Esq., CAE, IOM, is president and CEO of the Flexible Packaging Assn. (Annapolis, MD). She can be reached at 410-694-0800, email: fpa@flexpack.org, akeane@flexpack.org, www.flexpack.org

For more information on FPA’s advocacy work, contact John Richard, FPA director of government relations, at email: jrichard@flexpack.org