By Jennifer Dochstader, co-founder, LPC, Inc.

Introduction

Across the greater printed-packaging industry, conditions such as demand surges, force majeure, raw-materials shortages and allocations have had a profound impact on the ways that printed-packaging converters carry out their day-to-day business. However, perhaps the segment that has felt these forces most acutely is the label industry. Given the multitude of components that fundamentally make up all pressure-sensitive constructions, label converters’ delivery times of goods to their own customers is dependent entirely upon the availability of liner, adhesives, varnishes, face stocks, laminates, inks and plates.

The pressure-sensitive supply chain has been in a state of flux long before the start of the global COVID-19 pandemic. Tim Kirchen, senior vp-UPM Raflatac, comments, “There have been periods where companies have been on material allocation long before our current situation. There simply isn’t enough domestic raw-material supply. Over the last 15 years, the paper industry has consolidated significantly and has reduced capacity drastically. Secondly, a portion of the capacity that still is there is not necessarily allocated to label liners and face stocks. Other paper-affiliated sectors seem more attractive and that means paper suppliers have diverted production capacity to other end-use markets.”

In essence, the pandemic has served to throw even more fuel onto the flames of dwindling domestic-supply reserves as a result of the rising demand for printed products over the course of the past two years due to consumer behavioral shifts. Given the reality of today’s raw-material availability paired with other current issues that include reduced availability of pulp and papermaking chemicals, increased fuel and energy costs, ongoing mill closures and labor shortages, printed-packaging converters are facing a more challenging business landscape than they ever have.

Creating a forum for open discussion

As in other printed-packaging sectors, one of the North American label industry’s core challenges has been trying to convince brands and label buyers that enough value can be created in the manufacturing of labels to transcend the categorization of being deemed a commoditized product. Demand surges across end-use verticals in 2020 and throughout 2021 created an opportunity for converters to form deeper and more synergistic partnerships with their customers; however, 2022 has ushered in a new dynamic. Converters are reporting that this year’s supply shortages and rising prices have created a scenario where more of their customers are putting business out to bid, and label-vendor loyalty is waning.

At the in-person TLMI Converter Meeting this past spring, a panel of consumable-goods suppliers and narrow-web converters took the stage to discuss the state of the supply chain and the ways that companies are navigating the current crisis. During the extended panel discussion, converter participants were asked about the types of strategies their companies currently are employing to mitigate supply disruptions and the ways that they are fail-proofing their own production strategies. Panelist John Borrelli, COO of Luminer Converting Group, stated, “The thing that has worked for us the best during this time has been communication, and it’s a three-way street between our customer-service rep, our suppliers and our production team. The role of that customer-service rep is to let our customers know that everyone is on the same page and having challenges. We’re constantly in contact with our suppliers to receive availability and delivery status updates to confirm when scheduling can be done, and then it’s production’s job to let us know exactly when we can expect to ship.”

The digital label-printing space, a sector that prior to this year has been one of converter delivery times of several days and even within 24 hours, hasn’t been immune to disruptions either. As panelist Andrew Boyd, president of Blue Label Packaging Co., explained to attendees at the meeting, “We are an all-digital company and that means, practically speaking, that we have hundreds of jobs and thousands of customers that we have to account for. The current landscape has made us figure out how to be efficient about having the right kinds of conversations with our customers and, as time goes on, how to build processes around unexpected changes and a quick feedback loop built into our actual infrastructure. Basically, it’s providing the customer with their list of options, making the change and then communicating that out to production all electronically without having to reprint a bunch of documents and having people scrambling on the production floor.”

Gauging the impact of supply-chain forces in TLMI Market Watch

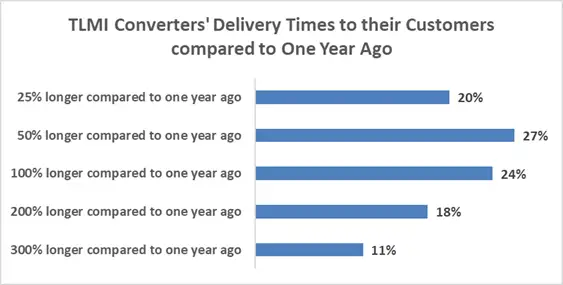

The TLMI Market Watch report is a resource for TLMI members that presents real-time market intelligence on a twice-annual basis. The report is compiled by industry research firm, LPC, Inc., and is made available to all association converter and supplier members. In the “2022 Converter Survey” for the report, converters were asked to quantify the extent to which their average lead times to their customers have increased due to the time it takes to receive raw materials, compared to their companies’ lead times one year ago. Figure 1 shows participants’ feedback.

One in five TLMI converters report that their delivery times are 25% longer compared to mid-2021, while more than one in 10 companies report that delivery times to their customers have increased by 300% or longer.

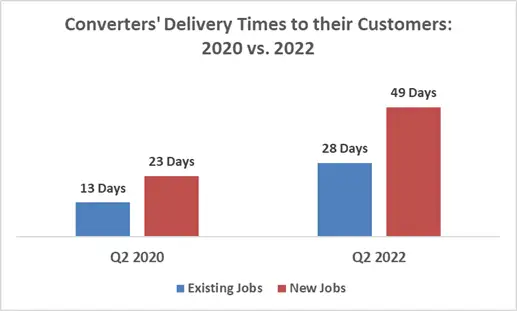

In early 2020, the association released a Market Watch report that published the results of an extensive “Brand/Label Buyer Survey,” and one of the areas that the report tracked was converters’ lead times to their customer base (see Figure 2). At that time, brands and label buyers reported that the average lead times from their label vendors was 13 days for existing jobs and 23 days for new jobs.

Given these estimates from two years ago and applying them to the most recent data received from TLMI converters, we can approximate that currently, the average lead times for the North American label industry is around 28 days for existing orders and 49 days for new orders. (Note: These figures are calculated using the lead-time increase percentage averaged from all converters’ responses as indicated in Figure 1.)

This data reinforces the urgency of continued transparency throughout the supply chain, as referenced by several of the TLMI Converter Meeting panelists quoted earlier. This has never been truer for both converters and suppliers.

Among the supplier panelists at the TLMI Converter Meeting was Catherine Heckman, business unit dir.-Bostik, who stated, “One of the things that we did very well was to become very transparent with our customer base. We had to get really, really good at listening, and for some customers we’ve set up weekly meetings with them. At one point, we had a converter in an extremely urgent situation, they were literally going to run out of product within a week’s time, so there was a lot of jockeying on our end to make sure their production didn’t shut down. The best part of that was that they came back to us a few months later, complimenting us on our transparency, and said that they now had ample inventory and didn’t need their allocated shipment of adhesive one week and that we could go ahead and send it to someone else who really needed it.”

Given the current market’s myriad challenges, the converter-supplier partnership has never been more critical. Yet, is there a light at the end of this current supply-chain tunnel? Raw materials suppliers presently are answering that question this way: Maybe.

While there have been some improvements in the availability of raw materials, there remains a backlog of orders that could take months to clear. Heckman continues, “We’re starting to ease some allocation requirements. I’m hoping that we’ll see more stabilization by late summer or early fall. However, every time we think there is an improvement and a softening in a segment, another raw material becomes an issue, so like the rest of the industry, we’re crossing our fingers and in the interim are continuing to communicate with our customers as openly as

possible.”

Jennifer Dochstader, a co-founder of LPC, Inc., has spent her life in the printed-packaging industry. Founded in 1998, LPC is a leading industry research, due diligence and marketing communications firm specializing in the label, flexible-packaging and folding-carton sectors. She can be reached at jennifer@lpcprint.com, www.lpcprint.com.