By Agrani Punj, partner & head of international business, Supervac Industries LLP

Since the beginning of 2022, the metallizing industry (along with the rest of the packaging industry) has seen a significant slowdown and a drastic decline in demand. This article aims to identify the reasons for this decline and discuss solutions to the challenges that vacuum metallizers and packaging-converting companies are facing today; namely, declining demand and reduced profit margins, increasing sustainability regulations and the problem of growing supply-chain volatility. This article will explore these challenges and identify possible solutions through practical examples of what companies are doing to emerge victorious.

Editor’s Note: This paper is based on the author’s presentation at the ARC R2R USA Conference held in Milwaukee, WI, in October 2023.

Introduction

The year 2022 saw the packaging industry reeling under major recession-like conditions. The extent of the slowdown was unprecedented and, to date, the demand is far from where it was in 2021 as companies continue to feel the heat of the slowdown.

The research for this article began in Q4 2021, well before the slowdown became apparent to the industry. At Supervac, we keep a very sharp eye on the happenings in the vacuum-metallizing field, and an imminent recession was visible to us even then. The good news is that slowdowns are temporary, and as the packaging industry grows, it will eventually emerge from this recession.

However, ever-changing times bring about new challenges, and the threats mentioned in this article are not temporary. They are here to stay and are recession-independent. The difference between who survives these threats and who doesn’t depends on which company realizes the dangers, takes corrective measures and adapts to the changing times – and which company doesn’t. These threats apply to the packaging industry in its entirety. However, because this firm caters specifically to the metallizing industry, we have analyzed metallizers, and the examples used in this article primarily are from the metallizing industry.

What are the three threats?

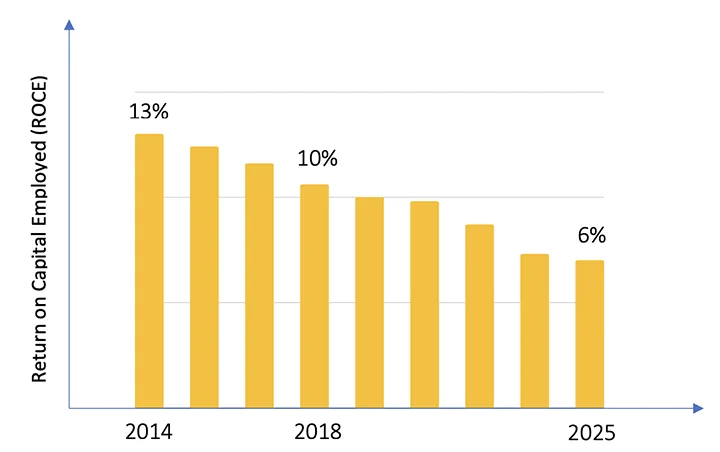

Reducing profit margins and falling demand: In 2018, McKinsey and Co. studied the average Return on Capital Employed (ROCE) of a company in the packaging industry globally. The ROCE is a direct indicator of the Profit Margins of a company [1].

Figure 1 shows the findings of the study. In 2014, the ROCE was 13%. By 2018, this number had dropped to 10%. That is a massive 23% decline in the ROCE. Going by this trend, by 2025, the average ROCE of the industry will be only 6%. Imagine a company giving returns of only 6%. At this rate, it would hardly even beat inflation in many cases.

The second part of this threat is falling demand. It came as a surprise to many that despite the growth in the packaging industry, since 2021, we have been experiencing a decline in orders [2]. Before 2021, this growth primarily was fueled by the following two factors:

- Rise in e-commerce: Beginning in 2013, the rise of e-commerce has led to a significant increase in demand for packaging.

- COVID-19: During the pandemic, we were packaging everything. We wanted to be sure that human hands had not touched anything we bought. This behavior led to considerable growth in demand for metallized films and packaging.

As a result of these factors, metallizers began expanding their capacities, and companies who were not previously metallizing bought vacuum metallizers and started using the process in their manufacturing.

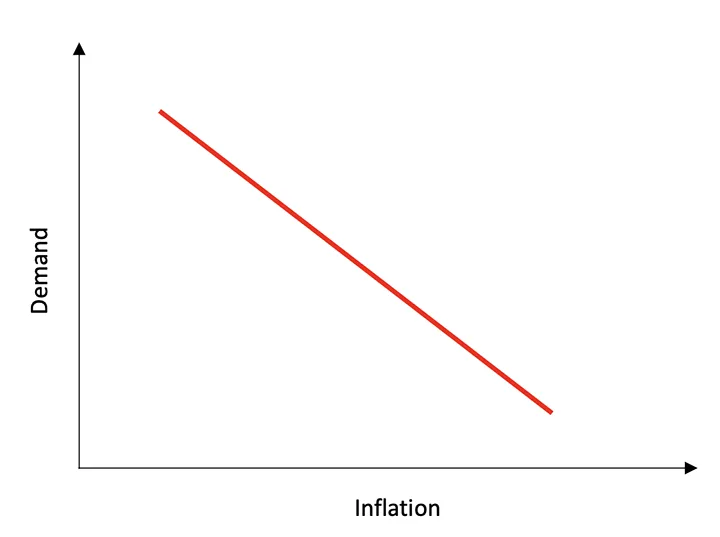

After 2021, the COVID-led fear driving the packaging of everything was mostly over; consumers no longer demanded that everything be packaged at its source. Then in 2022, we saw a rise in inflation. Figure 2 illustrates what happens when inflation rises. With rising prices, the buying power of consumers declines. This means that a consumer who previously bought a 5-kg bag of rice and kept some in excess now only buys precisely how much they need. This effect of a reduced buying pattern directly impacts the metallizing industry because the demand for FMCGs is linked directly with the demand for metallized films.

For the above two reasons, we saw a drastic decline in demand for vacuum-metallized materials and packaging. However, the supply capacities already had increased based on the demand patterns of 2021. Hence, we now are witnessing excessive supply and insufficient demand to offset that supply. To conclude, on one hand, profit margins are falling; on the other hand, machines are lying dormant without orders to fill, taking a further fit on industry profitability.

Sustainability regulations: Based on a McKinsey and Co. study, out of all the sustainability regulations, 83% are focused on plastics [3]. While it is positive that we are moving toward a greener tomorrow, it has significantly increased the burden on metallizers. This burden primarily is because of the following:

- Adhering to sustainability norms means altering our production methods and investing in research. Because profit margins are at an all-time low and the ongoing recession is breathing down on us, sustainability takes a back seat. However, since environmental deadlines already have been set by the government, sooner or later, we will have to invest money to adapt if we are to survive.

- Sustainability norms can be exceedingly ambiguous, and given that most of us are global players, which standard should we adhere to? India says that by 2025, brand owners, FMCG and packaging-converting companies must account for 35% of their plastic waste. Europe says that by 2030 all packaging must be compostable, recyclable and/or biodegradable. We now are seeing a rise in paper metallizing; however, some argue that improper use of paper leads to deforestation, which is not suitable for the environment either.

- The lack of investment money to change our production processes, and the ambiguity of what specifically is to be done, is what makes sustainability a significant threat for the metallizing field.

Supply-chain volatility: A study conducted by Interos on global supply chains concluded that in 2020, during the COVID pandemic, 97% of Fortune 1000 companies faced supply-chain breakdowns. One might argue that only the pandemic was causing the breakdowns. However, in 2022, after the major effects of the pandemic essentially were over, 65% of the same Fortune 1000 companies said they faced supply-chain breakdowns again [4].

Now, while these are the largest 1,000 companies in the world, belonging to various industries and with supposedly robust supply chains, it still proves that we inherently live in a very volatile world today. In 2022, we saw the Russia-Ukraine war, container shortages and COVID-19 lockdowns in China, the rising cost of power in Europe, and workforce shortages globally. 2023 was the same, along with lackluster market demand due to rising inflation.

Companies should not measure the cost of supply-chain breakdowns as only the revenue loss caused by production decline. One also must account for the loss of reputation before your customers and the dilemma of buying from alternate, possibly untested suppliers at even higher prices.

This is why supply-chain breakdowns cannot be taken lightly and are the third most significant threat we face today. We must rely on something other than our tried-and-tested methodology of building a supply chain. To stay competitive, we must consider the global situation and diversify our networks as much as possible.

What can we do to counter these threats?

Reducing profit margins and declining demand: Our team has identified three potential ways to tackle the continuing trend toward lower profit margins and product demand. They are:

- Differentiation through innovation: Innovation is the best way to invest our money. It helps us differentiate from other players and gives us the leverage to charge higher margins than competitors because we are offering something that no one else does in the market. For example, traditional metallized films are known to have low flexural strength. TOPPAN has introduced a new metallized barrier film with higher flexural strength than other films in the market [5]. Through innovation, TOPPAN has thus been able to differentiate itself.

- Improve operational efficiency: It is said that “money saved is money earned.” In 2021, Berry Global reportedly saved 100 million kWh of energy globally [6]. Each of the company’s plants across the globe contributed to the energy-saving targets. Besides saving energy, we can reduce costs by switching to suppliers who provide excellent quality at lower prices. By lowering costs, profit margins can go up automatically.

- Exclusive agreements: Signing exclusive customer agreements is an excellent way of tackling declining demand and profits. When demand is assured, we can invest in developing new technologies with less worry. For example, Pure Cycle Technologies signed an exclusive agreement with Procter & Gamble to supply recycled polypropylene (PP) at virgin-like quality [7]. Through the deal, Pure Cycle Technologies is assured of a customer, and P&G is assured of a supplier exclusively producing a novel technology for them. It’s a win-win for both parties.

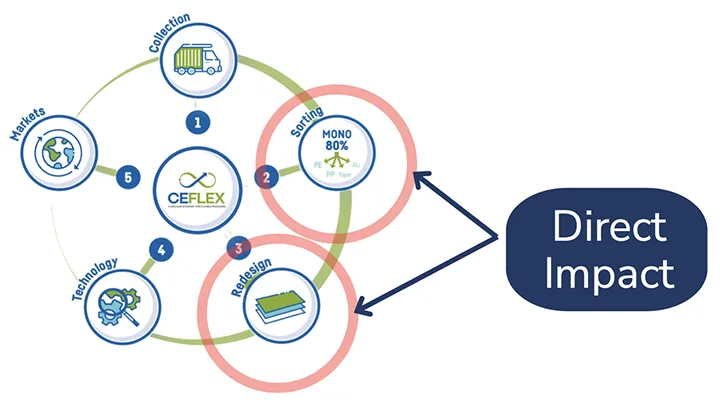

Sustainability regulations: The threats behind sustainability regulations can be tackled by understanding the basics of sustainability. Figure 3 explains the recyclability of a material. This process has been endorsed by CEFLEX [8].

As converters and metallizers, Steps 2 and 3 are the most relevant. The packaging sorting and redesigning stages explain that converters must redesign their films so that they use as few layers as necessary. Usually, in a multilayer-film structure, several layers, such as PP, cast-PP and biaxially oriented PP, are laminated to make one construction. CEFLEX endorses that, as far as possible, use only a single layer or a mono-material structure of only one resin type. A monolayer film can then be metallized and surface-treated for additional barrier properties. According to CEFLEX, the extent of additives, including metallization, should be at most 5% of the total film to be counted as recyclable [8]. Moving from multilayer films to mono-layer or mono-material films also means we may be able to use less plastic than before to achieve the same properties.

For extruders and converters, practically, we need to make changes in:

- Extrusion technology: Extruding a multilayer film vs. extruding a mono-layer film is different.

- Performance enhancement: For the mono-layer film to have similar barrier properties as the multilayer film, we may need to do additional performance enhancement on the film surface.

- Converting and sealing: The metallization process on a multilayer film vs. a mono-layer film can be different.

- Quality control and testing: These parameters may differ when the film layers differ.

Whether we are ready for it or not, sustainability is becoming increasingly relevant and essential in today’s changing times. Our prerogative is to sit down with our team and discuss how much and what we can implement at our plants.

Supply-chain volatility: There are three types of vendors one can have:

- Excellent quality but higher prices

- Lower prices but quality typically is lower as well

- Quality and price are acceptable, but service is abysmal

Today, all three scenarios are unacceptable. An ideal vendor should be a master of all three parameters: quality of goods; price; and quality of after-sales service.

Secondly, another aspect regarding supply chains is that we must understand that each of us converters is unique. For example, some are metallizing on paper and others on films. Some are using aluminum to metallize; some are using copper. Some are metallizing with a high optical density, and some regularly achieve low optical densities. We need suppliers who understand our needs and processes and provide customizable goods and services for our customized needs.

Taking care of the above two points will go a long way toward solving our supply-chain challenges.

Conclusion

We have discussed the three major threats facing the vacuum-metallizing and packaging industries, namely falling profit margins and product demand, sustainability regulations and supply-chain volatility. All three challenges have the potential to wipe out any organization. We also discussed possible steps to safeguard ourselves from and to address these threats. With this, I hope to spark innovation and conversation on how to emerge victorious in these trying times.

References

- https://www.investopedia.com/terms/r/roce.as

- https://www.inventiva.co.in/trends/challenges-flexible-packaging/

- https://www.mckinsey.com/industries/packaging-and-paper/our-insights/sustainability-in-packaging-global-regulatory-development-across-30-countries

- https://fortune.com/2020/02/21/fortune-1000-coronavirus-china-supply-chain-impact/

- https://www.holdings.toppan.com/en/news/2022/04/newsrelease220407.html

- https://www.berryglobal.com/en/news/articles/13126-berry-global-surpasses-goal-to-eliminate-100-milli

- https://www.purecycle.com/blog/purecycle-technologies-pg-introduce-technology-enables-recycled-plastic-nearly-new-quality

- https://ceflex.eu/

Agrani Punj, partner and head of international business at Supervac Industries LLP (New Delhi, India) holds a Bachelor’s in Mechanical Engineering and an MBA from the Indian Institute of Foreign Trade. As a second-generation entrepreneur, she is carrying forward the legacy of Supervac. Agrani has over 10 years of experience in the metallizing and flexible-packaging industry and currently manages sales and business development at Supervac. She can be reached at +91-72909-32695, email: agranipunj@supervaccoils.com, www.supervacoils.com.