By Jay Baxter, commercial product dir.-Liquid Coating, Davis-Standard

With the implementation of the Bipartisan Infrastructure Law and the Inflation Reduction Act, there are tremendous resources and incentives that will influence growth of battery and hydrogen-fuel manufacturing in the United States. In addition to grants to install new production in the US, there are additional incentives on electric vehicles (EVs) that will be applicable for EV vehicles only where the battery is nearly entirely US-made. The R2R-converting industry should take this onshoring opportunity to improve the battery separator and fuel-cell, proton-exchange membrane manufacturing process through automation and throughput increases to catch up with Chinese technology and scale in this market.

Introduction

With the passing of the Bipartisan Infrastructure Law (BIL) and the Inflation Reduction Act (IRA), the United States government is making a large investment in the onshoring of battery and fuel-cell manufacturing for the electric vehicle (EV) market. The current state of the lithium-ion battery market is dominated by companies and entities outside North America. Effectively, none of the mining and processing of critical minerals, such as lithium, nickel, cobalt and graphite, are done in the US. Similarly, very little of the manufacturing of EV batteries happens domestically. US manufacturers produce very little of both the cathode and anode materials and assemble less than 10% of EV lithium-ion cells globally.

The BIL is an investment that intends to move the battery supply chain to the US and USMCA (formerly NAFTA) partners Canada and Mexico as a matter of national security. The portion of the IRA that pertains to batteries aims to increase demand for American-made batteries. The benefits of these laws will be substantial through the increase in American jobs in mining and manufacturing as well as reducing use of fossil fuels by reducing the cost of EV vehicles. So, as a bit of background, what is in the BIL and the IRA?

The basics on the bills

The Bipartisan Infrastructure Law, among many other things, provides $7 billion of funding to build battery and fuel-cell infrastructure in the United States. The first set of projects, totaling $2.8 billion, was announced in November 2022. This funding was for battery-materials processing and battery manufacturing and recycling. The US Department of Energy announced a second round of funding of up to $3.5 billion to boost the production of batteries and battery materials. The funding awards are due to be announced in mid-2024. Among other focus areas, the funding will focus on projects that will “expand production facilities for cathode- and anode-materials production, and expand battery-component manufacturing facilities.” While it is unlikely that companies in the traditional roll-to-roll converting industry will qualify for such funding, the boost to the battery industry certainly will lead to new roll-to-roll (R2R) converting-equipment projects for electrode foils, as well as battery-separator and fuel-cell membrane films. It is unclear as of this writing (February 2024) as to whether new equipment purchases will be required to be from US companies, but the increased demand cannot hurt in any case.

The Inflation Reduction Act, like the BIL, deals with quite a few subjects while also having a direct impact on US battery manufacturing. Whereas the BIL specifically is trying to improve the supply side of the battery market, the IRA has incentives that are stoking the demand for electric vehicles. Buyers of a new EV would be eligible for an immediate credit of up to $7,500, depending on the supply chain of the battery in the vehicle. The credit is no longer a tax credit but a discount that can be offered at the dealer. The credit is not eligible for vans, SUVs or pickup trucks with an MSRP over $80,000 or for cars with an MSRP over $55,000. Also, there are IRS adjusted gross income (AGI) requirements; for example, married couples making an AGI over $300,000 would not be eligible.

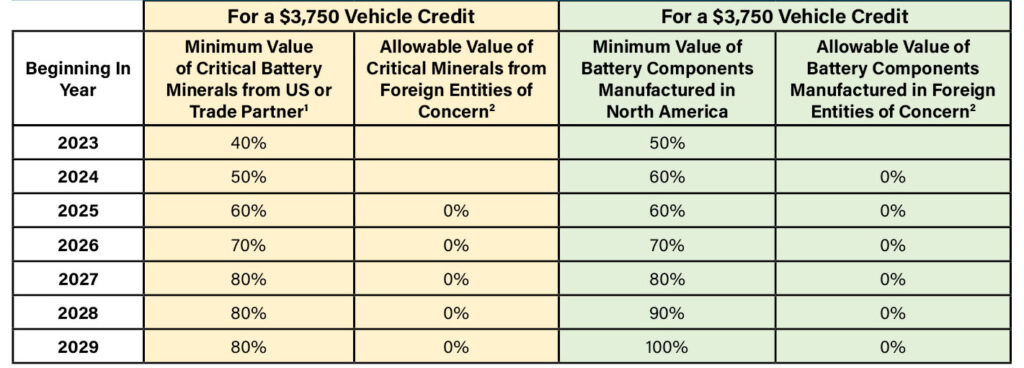

The credit is in two parts: one half for the mineral value in the vehicle’s batteries and another half for the value of the battery components. Each requires a minimum percentage of the value to be manufactured by companies in North America or with US trade partners (see Table 1). The IRA also restricts the level of minerals or battery components that are made by foreign entities of concern (FEOC). For car manufacturers to ensure their vehicles will get the IRA credit, they must abide by a requirement that their batteries have no FEOC-made components by 2024 and no FEOC-supplied minerals (other than some trace amounts) by 2025.

As of this writing (February 2023), the Dept. of Energy has proposed new guidelines for both the BIL and IRA concerning FEOCs. These rules define the FEOCs as the People’s Republic of China, the Russian Federation, the Democratic People’s Republic of North Korea and the Islamic Republic of Iran. In practice, for battery manufacturing, this rule affects China and Russia the most. China has very large anode, cathode and battery-cell manufacturing capacity, and Russia is an exporter of minerals such as nickel and cobalt. The new rule would not allow any company with more than 25% FEOC ownership to participate in the benefits of the BIL or IRA. The proposed rule is very long and tries to address any loopholes, but there always will be judgment calls. An early example is Microvast, which was withdrawn from the first BIL projects awarded because of Chinese links. How the government will rule on joint ventures or licensing agreements is unclear. For example, if a US company were to license technology from an FEOC-based company, which does not have any ownership stake in the venture, it might be allowable. Time will tell.

Not a 100% solution

All of this governmental stimulus seems like it should be a win for the North American converting-equipment industry, especially for the coating of foils and films for electrodes and separators. Even if there are no restrictions on using foreign equipment in North American plants, all of the new investment will benefit the industry. However, this doesn’t mean that all the problems are solved.

For instance, there is a growing business for premium EVs, such as Rivian and Lucid Motors, whose vehicles are not likely to receive any IRA credits due to their price level. Presumably, luxury EVs could continue to use foreign-made batteries as the cars will be sold without IRA credits, regardless of the battery source. The battery market, and similarly, the R2R converting industry, cannot rest while foreign companies have a lock on the lithium-ion market. New technology like solid-state batteries is one way, but it appears that wide adoption of solid-state is a late-in-the-decade event at the earliest. The North American market needs to find a way to be competitive with lithium-ion batteries because government subsidies and trade protections can only go so far.

Change converting processes, add automation

The US likely will be disadvantaged in labor cost vs. developing nations for the foreseeable future. The domestic battery market can lessen its disadvantages in labor costs by taking advantage of automation. The roll-to-roll equipment manufacturers need to think differently: how can we build these converting assets to run with the fewest number of people? With battery webs, this becomes especially true; many of the battery films and foils are run at small diameters to reduce the chance of roll defects, such as wrinkles, marring much of the film on a roll. Furthermore, many of the films and foils currently are run at narrower widths than what is common for converters. Increasing the roll sizes while avoiding increased quality defects is an obvious target.

A second target is automation. Automatic roll change for both unwinders and rewinders is a long-established technology in the R2R-converting equipment industry. Perhaps some refinements need to be made for this industry to ensure that roll tails at the beginning or the end of the roll do not damage delicate battery materials. Additionally, completely autonomous core loading also could be very effective for battery foil and film coating. One operator could load cores into the loader and then have hours to spend performing tasks other than putting cores on a shaft (see Figure 1). (Also read “The ROI of Automation: A shrinking labor force and productivity gains” on page 88.)

Automatic roll handling likewise could be used to unload the rolls from the winder for further processing or packaging steps (see Figure 2). Similar solutions are available for the automation of the beginning of a R2R film- or foil-coating machine. One operator could load a series of uncoated film rolls into a roll-holding magazine. After an automatic roll change, a new roll of uncoated film from the magazine is placed in the empty position of the turret unwinder. Like the previously mentioned example with the winder, the operator is freed to perform other, more value-adding tasks.

Conclusion

The US government is doing a great deal to improve the battery-manufacturing infrastructure and increase the demand for electric vehicles. While this provides some short-term benefits for the domestic R2R-converting equipment industry, improvements must be made for the North American battery market to be competitive on the world stage. Using automation is key to reducing costs in higher-priced labor markets.

Resources

- US Department of the Treasury, https://home.treasury.gov/news/press-releases/jy1379

- Federal Register, https://www.federalregister.gov/documents/2023/12/04/2023-26513/section-30d-excluded-entities

- Federal Register, https://www.federalregister.gov/documents/2023/12/04/2023-26479/interpretation-of-foreign-entity-of-concern

- The White House, https://www.whitehouse.gov/briefing-room/statements-releases/2022/10/19/fact-sheet-biden-harris-administration-driving-u-s-battery-manufacturing-and-good-paying-jobs/

- Bloomberg, https://www.bloomberg.com/graphics/2023-breaking-china-ev-supply-chain-dominance/#:~:text=China%20Dominates%20EV%20Battery%20Supply%20Chain%20After%20Mining&text=The%20country%20processes%20more%20than,polluting%20and%20creates%20toxic%20waste

- US Department of Energy, https://www.energy.gov/articles/biden-harris-administration-announces-35-billion-strengthen-domestic-battery-manufacturing

- Reuters, https://www.reuters.com/business/autos-transportation/us-lawmakers-demand-documents-ford-battery-partnership-with-catl-2023-09-27/

- Reuters, https://www.reuters.com/technology/us-cancels-talks-200-mln-microvast-battery-company-source-2023-05-22/

Jay Baxter, commercial product dir.-Liquid Coating at Davis-Standard LLC (Fulton, NY), holds a Bachelor of Science in Chemical Engineering from the University of Virginia and an MBA from the University of Georgia. He worked for 18 years at Kimberly-Clark Corp., beginning as a paper scientist and progressing through numerous roles, including process engineer, operations manager, purchasing manager and business development manager for nonwovens sales. Jay later transitioned to marketing director with Neenah Paper for coated technical-paper substrates. He currently leads the sales and marketing efforts for liquid coating equipment at Davis-Standard. He can be reached at email: jbaxter@davis-standard.com, www.davis-standard.com.