Emerging sodium-ion technologies, sustainable components are key current trends.

Edited by Editor-in-Chief Mark Spaulding

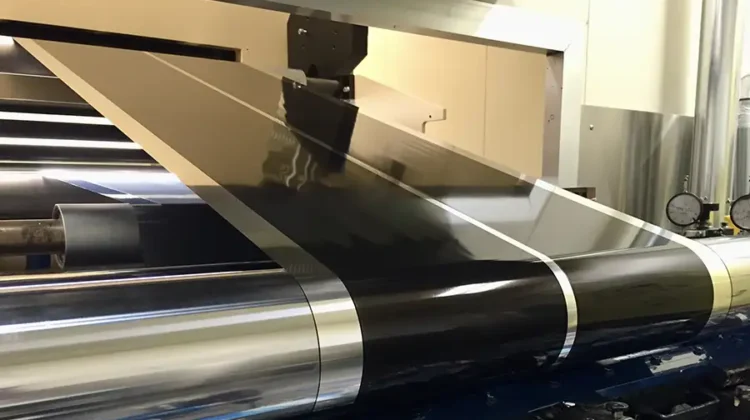

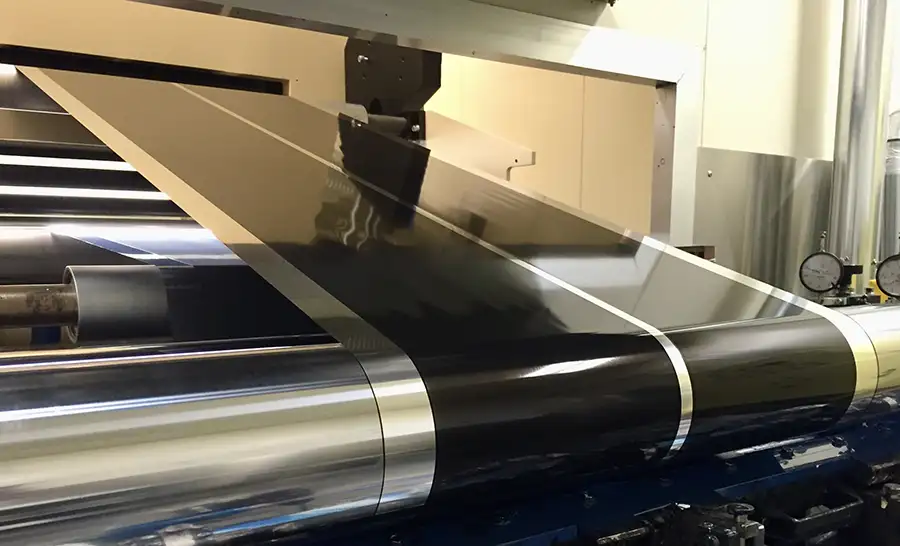

With their comparatively high performance, low cost and wide availability, lithium-ion (Li-ion) batteries are today’s pre-eminent energy-storage technology for applications ranging from small personal electronics to electric vehicles (EVs) to large, stationary energy-storage systems. For most such uses, Li-ion batteries are unlikely to be superseded within the next 10 years. Nevertheless, innovation continues to be made in Li-ion materials, R2R manufacturing, cell and pack design, and investment in the industry continues at a rapid pace.

UK-based technology researcher IDTechEx forecasts the Li-ion battery market will grow to more than $430 billion by 2033, driven by demand for electric vehicles. EVs remain the key driver behind the Li-ion market and electric cars will be the largest market for Li-ion batteries over the next 10 years. Despite the ongoing effects of COVID-19, chip shortages and other supply-chain issues, electric-car sales reached 6.4 million units in 2021. That number is expected to quintuple by 2030.

To meet this rapidly growing demand for Li-ion batteries, there has been correspondent growth in the number of gigafactories planned and announced over the past few years. While major incumbent manufacturers are at the heart of these developments, startups also are looking to enter the market, especially in Europe and North America where there is a drive to develop domestic capability. IDTechEx estimates new cell-production capacity will reach 3 TWh by 2030 – a measure undreamed of only five years ago. The US is likely to account for about 15% of this future capacity. While this still would not meet forecasted demand, the time needed to build new cell-production factories is relatively short, opening up even more opportunities for R2R converters to enter the field (see Figure 1).

Despite the importance of the EV market for the industry, stationary energy-storage systems are seen as the fastest-growing market for Li-ion batteries, given rapid adoption of renewable power sources such as solar and wind. And along with a seemingly perpetual battery demand for electronic devices of all types, new technologies can therefore make their way onto the market via these applications first, with their higher margins, shorter product cycles, and less-demanding performance requirements compared to EVs.

Emerging alternative sodium-ion technologies

Because Li-ion battery raw-material deposits are unevenly distributed and prone to price fluctuations, the value chain is under unprecedented pressure, resulting in a need for alternative energy-storage chemistries. The sodium-ion battery (SIB) is one of the most promising “beyond-lithium” technologies. IDTechEx forecasts global demand for SIBs to grow from 10 GWh in 2025 to 70 GWh in 2033, at a market value of more than $11 billion.

Sodium-ion batteries are an emerging battery technology, on the cusp of commercialization, with promising cost, safety, sustainability, and performance benefits when compared to lithium-ion batteries. They use widely available, inexpensive raw materials and existing Li-ion production methods, promising rapid scalability. Unlike lithium, sodium does not electrochemically alloy with aluminum at room temperature, thus the copper-current collector on the anode can be replaced by cheaper aluminum. This not only lowers SIB costs but also reduces transportation risks because SIBs can be transported completely discharged – at zero volts. Hard carbon is typically used as the anode active material instead of graphite, as crystalline graphite has poor storage for sodium ions. Various cathode chemistries based on layered transition metal oxides or polyanionic compounds can be used. Electrolytes and separators, as well as the positive current collectors, are similar to Li-ion batteries, except for the use of sodium salts in the electrolyte.

With a lower energy density than Li-ion, SIBs do have potential applications in stationary energy storage, electric two- and three-wheelers, and electric microcars. Currently, very few players have commercial SIB products on the market, and even those with products available are supplying in limited quantities for trial projects. IDTechEx has identified about 15 companies developing their own SIB technology to match expected applications of their products.

Sustainable batteries & components

And what would any market be today without thought given to sustainability? Li-ion batteries, SIBs and other breakthrough technologies are no exception. This chain falls into two major categories: recycled (aka “second-life”) batteries and sustainable raw materials for original components.

IDTechEx forecasts the second-life, EV-battery market to reach $7 billion by 2033. The bulk of EVs currently use Li-ion chemistries, and once their 8- to 10-year initial lifetime has expired, they usually are unsuitable for future EV use. But that doesn’t mean the landfill is the only destination. Solutions are coming in improved suitability for second lives in the first place as future lower-power applications, better recycling processes to break down packs into component parts, and maximizing the value of used materials for (perhaps) totally unrelated products.

One of many examples for sustainable raw materials is Norway’s Vianode, which recently took ownership of the site for its first industrial-scale plant to produce battery-anode graphite from renewable sources. It plans to eventually deliver such sustainable battery materials for 2 million EVs per year by 2030 and help build up European domestic capacity. The graphite from Vianode is said to be produced with up to 90% lower CO2 emissions than today’s standard materials. They reportedly have unique performance characteristics and improve battery properties, including faster charging, increased range and longer service life, as well as increased safety and eventual recyclability.

More info: www.idtechex.com