By Dr. Conor O’Brien, Senior Technology Analyst at IDTechEx

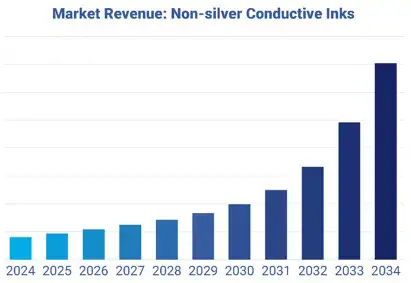

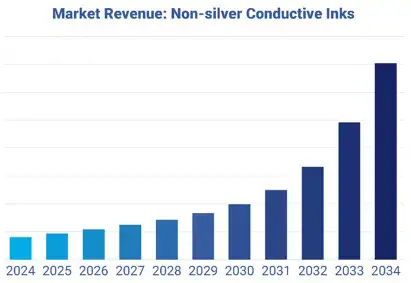

Silver-flake-based inks lead the conductive inks market, but the outlook for non-silver inks will change in the next 10 years, with a compound annual growth rate (CAGR) of 24%, says IDTechEx.

Silver-flake-based inks currently dominate the conductive inks market, but the outlook for non-silver inks is set to change dramatically over the coming decade, with a compound annual growth rate (CAGR) of 24% (see Figure 1), says Cambridge, UK-based market intelligence firm IDTechEx. Stretchable/thermoformable inks and copper inks will seize the largest market share, driven by applications such as in-mold electronics, wearable electrodes and RFID and smart packaging.

The firm’s report, “Conductive Inks Market 2024-2034: Technologies, Applications, Players,” provides detailed 10-year market forecasts and insights into a conductive inks market currently led by the success of silver-flake-based inks. These inks are more cost-effective than their alternatives due to straightforward processing and compatibility with existing deposition methods. Additionally, they are durable and exhibit excellent flexibility, essential qualities for most printed or flexible electronics. Currently, silver-flake-based inks are widely used in photovoltaics. However, the future of these dominant inks is poised for transformation in the next decade, with new opportunities emerging in applications such as 3D electronics, printed heaters, and RFID and smart packaging.

Stretchable/thermoformable conductive inks

Stretchable and thermoformable conductive inks are designed to withstand strain, either repeatedly or in a single instance, without breaking or experiencing a significant increase in resistance. This generally is achieved by incorporating elastomeric binders within a flake-based silver ink, though other formulations also can be employed.

There usually is a trade-off between stretchability and conductivity, as increasing stretchability requires a higher proportion of elastomers, which reduces the amount of conductive material. Making an ink stretchable while retaining its conductivity introduces technical challenges. This presents a significant R&D opportunity for materials and chemical companies. For instance, when a printed conductive line is stretched, the conductive particles move apart. Therefore, only if the ink is properly optimized will the conduction path be maintained during elongation.

Printed wearable electrodes require that both the electrodes and conductive interconnects need to be stretchable and flexible, since the electronic skin patch needs to be conformal and adjust to the wearer, and conductivity is not a priority. As such, stretchable and thermoformable inks are projected to achieve significant growth in this sector over the coming decade. This growth will be driven by increased demand for continuous healthcare monitoring (especially post-COVID, with people reluctant to visit their doctors in person) and the ever-more popular wearable technology for wellness/fitness monitoring. Beyond wearable electrodes, in-mold electronics (IME) is another area where these inks will seize a significant portion of the market, particularly in automotive applications.

Copper conductive inks

The primary advantage of copper inks is the potential for significantly lower costs compared to silver-based inks, as copper is approximately 100 times cheaper as a raw material. This cost-benefit will become even more pronounced if raw material prices increase, given that material costs account for a larger portion of the total cost for silver inks. Additional benefits of copper over silver inks include improved solderability and enhanced sustainability. Previous attempts to introduce copper conductive inks to the market as an alternative to silver have struggled to gain traction due to the cost and complexity of dealing with the problem of copper oxidation issue, while specific processing conditions still are required when sintering some copper-based inks. For applications where durability is required, additional encapsulation is required relative to silver to prevent oxidation.

The primary market for copper-based inks will be in RFID (radio frequency identification) and smart packaging, projected to exceed $500 million by 2034. RFID is a well-established technology, used in applications ranging from bank cards to retail inventory monitoring, while smart packaging can be regarded as an evolution of RFID – often identifying the product, but adding additional functionality such as sensing for movement, temperature or humidity. At present, IDTechEx estimates that only around 1.5% of RFID antennae are printed, with most being either stamped or etched.

To effectively print RFID tags, the conductive ink must be low-cost and exhibit compatibility with established graphical printing methods. Since most smart-packaging and RFID tags have a relatively short lifetime, the inks do not need to last for years, while the environment also is not too harsh, with no washing or dramatic temperature fluctuations. Copper-based inks are well placed to enable printed RFID tags by fulfilling these critical properties.

More info: research@IDTechEx.com, www.IDTechEx.com