Worldwide release-label demand up 3.5% for all end-use markets: AWA

Editor’s Note: The data referenced in this article were developed before the COVID-19 pandemic took hold in March 2020. Readers should keep this in mind as it pertains to short-term forecasts.

By Ann Hirst-Smith for AWA Alexander Watson Associates

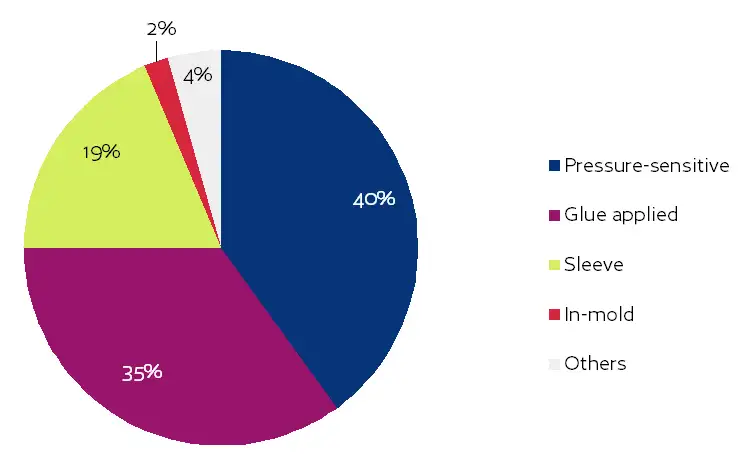

According to AWA’s most recent research, global demand for labels grew by a healthy 3.2% in 2019 over the prior year to a total value of $26.6 billion and a material-production volume of 66.216 billion sq meters. These positive numbers are, of course, spread across a number of different technologies, but primarily pressure-sensitive and glue-applied labels, sleeve labels and in-mold labels. It is worth looking at the different technologies and the different geographical regions to establish a current status and key future needs to maintain a healthy industry base.

Pressure-sensitive labels

(Source: AWA)

In 2019, the pressure-sensitive (p-s) label sector grew slightly more than overall global label growth – 3.3% – and today represents a 40% share of the market (see Figure 1). One area of end use that is likely to enjoy continued vibrant growth is in variable information printing (VIP). In this age of e-commerce, internet retailing and related logistics, VIP labels deliver the product identifiers that are the key factors in supporting a safe, trustworthy supply chain. In addition, it’s worth underlining the VIP market segments using advanced track-and-trace security solutions for authenticating pharmaceutical and medical products – also supported by pressure-sensitive labels.

In the primary product label markets, pressure-sensitive labels claim a 23% share – particularly in the food, beverage and health and personal-care end-use segments. Around the world, more private-label product manufacturing, brand versioning (especially short-run label printing using digital technologies) and expanding regional markets all represent continued growth opportunities for p-s labels.

Round the regions

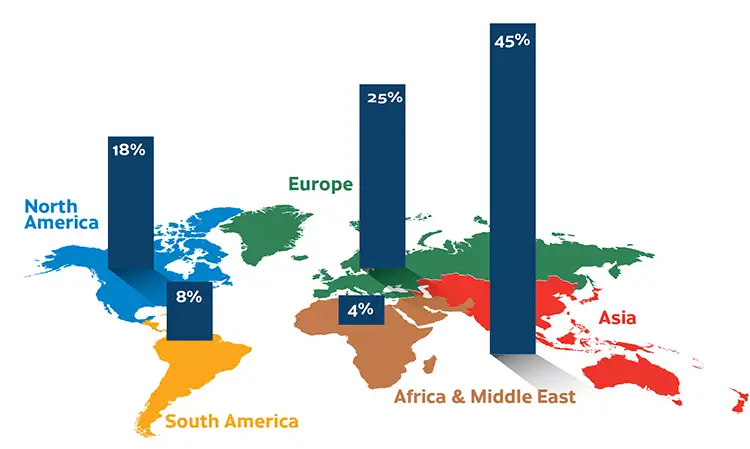

Growth in the labeling field around the geographical regions of the world continues to be dominated by Asia, which grew in 2019 at 4.7% and claims a 45% share (see Figure 2). It remains the regional market with the highest future opportunities and, with its current focus on pressure-sensitive primary product labels for foods and VIP labels for transport and logistics applications, is likely to expand considerably. In China, India and Japan, pharmaceutical labeling also is a growing market for advanced pressure-sensitive formats, such as functional/security labels. China, Japan, Korea, Taiwan and Malaysia are the leading global manufacturing sources for consumer durable products and electronics – and here durable pressure-sensitive labels meeting such international standards as WEEE, RoHS, IMDS and UL therefore also are in high and increasing demand.

However, the future regional market of opportunity now is in Africa and the Middle East, which grew last year by 3.3%. Currently, South Africa, Israel, North Africa and the Middle East are the main areas of regional market activity.

The mature markets of North America and Europe managed to achieve only 2.1% and 1.9% growth, respectively, in 2019. South America, at 1.6%, is at last recovering slowly from its economic crisis.

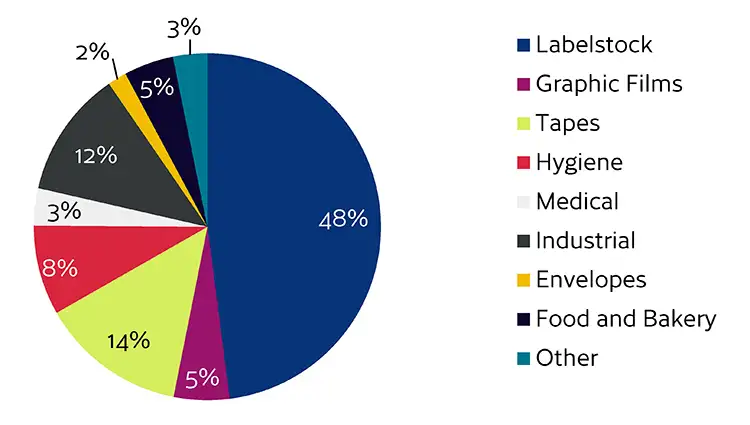

Release liner – a broader profile

Still dominated by labelstock (with a 48% market share), the other market segments in which release liner provide key support include hygiene, medical, industrial, envelope, tapes, graphic films, food and bakery, electronic goods, building and construction and composites manufacture – as the recent AWA Global Release Liner Conference highlighted (see Figure 3).

Release liner is a strong, developing industry that grew at 3.5% in 2019, and it is innovating to cope with new challenges – mostly in the coating, or surface treatment, of release base, as well as in nanotechnology and biomaterials. Overall, the global release-liner field could grow 5% this year, with the Asia region climbing 6.5%.

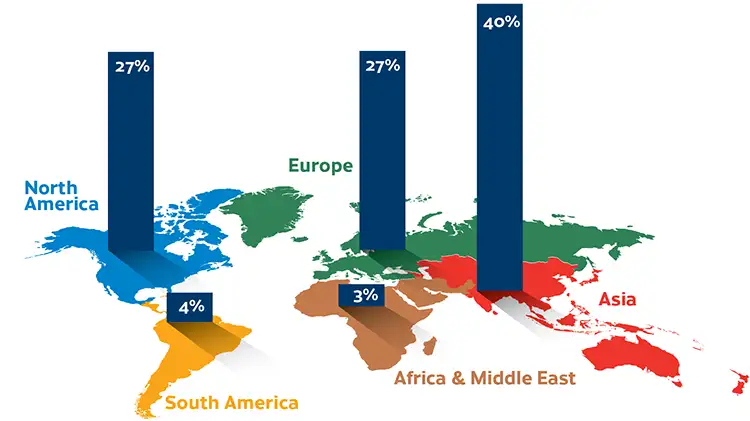

Glassine and SCK paper remain the largest substrate-category choice for release liner, with a 36% share of the market, followed by PET film, now at 16%. Asia, currently with a 40% market share, remains the fastest-growing region, while North America and Europe both come in with 27% shares of global material-production volume (see Figure 4).

Glue-applied labels

Traditional glue-applied labels still claim 35% of world label demand. Using the central, analog roll-to-roll printing technologies, they now are enjoying moderate growth, with emerging geographical markets being the drivers. Wraparound labels are growing at a higher rate than cold wet-glue-applied labels, however.

Sleeve labels

The rising stars are the sleeve-labeling technologies, now representing 19% of global labeling material-production volume and offering a choice of formats – heat-shrink TD, stretch, ROSO™ MD and RFS MD sleeving. In terms of volume, growth and popularity with brand owners, heat-shrink TD sleeving is the most successful, now with 89% of the global sleeving market (see Figure 5). It uniquely provides the 75% shrinkage or distortion capability that complex container shapes demand – particularly in today’s fast-growing market for on-the-go drinks and snacks in contoured plastic containers. Such applications are delivering, for brand owners, a much-expanded opportunity for decoration, enabling 360° brand identity and the optional added element of security in over-the-cap applications. To simplify recycling of such plastic containers, many heat-shrink sleeve labels today are perforated, so consumers may separate them from the container after use.

In-mold labels

Still with a very small share of the global labeling market – just 2% – in-mold labels are beginning to establish themselves as a mainstream label format in the converting market. For brand owners, they offer manufacturing economies and efficiencies without sacrificing product-packaging aesthetics; and with expanding consumer markets around the world, they will continue to attract more interest from the manufacturers of spreads, ice cream, yogurts and similar high-volume consumer food and drink products.

Europe is the leading regional user for in-mold labels, and the market grew last year at 1.7%, but the highest percentage growth rate was seen across the Americas – although from a low-volume base in South America.

An emerging labeling technology

Direct-to-container print – on plastic, glass and metal containers – is an emerging technology that offers added brand-owner feature options in terms of limited editioning and personalization while also being a first-class focus arena for digital print. AWA research indicates that the health and personal-care product sectors, as well as household-chemical products, are the most likely end-use markets to adopt the technology.

Sustainability & liner recycling

Sustainability and recycling are prime concerns today in every industry, and an increasing level of related international legislation today is directing activity in labeling and packaging. Downgauging of label and packaging substrates – and focusing on monomaterials as opposed to multilayer structures – already is evident. Pressure-sensitive and shrink-sleeve labeling are additionally faced with concerns over waste creation at the label production and application stages. P-s labeling’s volumes of “by-product” – compared to other packaging print – are relatively small but complex.

The mixed nature of a pressure-sensitive label (clean adhesive-coated label laminate, printed/diecut laminate, matrix waste, siliconized release liner) has necessitated developing industry-specific recycling. Today, collection and recycling/second-life solutions, covering label converter and label application sites, are successfully functioning in many countries – good news, since high-quality release-liner base is entirely suited to second-life uses. In a recent survey, 74% of label industry companies approached by AWA researchers said they now have a working recycling program.

Shrink-sleeve labels are not necessarily compatible for recycling with the containers to which they are applied, but here again there is positive movement. Perforated shrink sleeves that the consumer may “unzip” after use to simplify recycling are available, and developments in fully recyclable sleeving film are coming on-stream.

Looking ahead

What then are the growth trends for the future?

Pressure-sensitive labeling’s versatility will keep it healthy, despite growing sustainability concerns around associated production and application by-products. VIP labels will certainly be a growth driver, while primary product labeling will continue to experience competition from other labeling technologies. However, in primary product labeling, developments in private-label products for retail and brand versioning represent continued growth opportunities.

Broader options in imaging technology: Digital-print technologies have introduced new possibilities – shorter print runs for brand versioning or local-language labels, as well as for specific brand identities and personalization. To meet this widening range of label and product-decoration options, analog-print processes (particularly flexo) are increasingly, and very successfully, partnering with digital print.

Future challenges: Still in its early days of use, the option of direct-to-container digital print – eliminating the need for a label substrate and therefore reducing costs – now is attracting interest from brand owners. Any increase in its acceptance certainly offers competition to the traditional label industry as a whole.

Other ongoing areas of concern are increasing costs – particularly for transportation and energy. And, as a result of the COVID-19 pandemic, across all levels of the value chain in the medium term are disruptions in the availability of supplies.

The changing face of business

Both local and global brand owners are investing strongly in online, as well as retail sales techniques and consumer promotion, both in North America and Europe and in the growing regional markets. The world’s converting base will certainly increase to meet these needs, and the print technologies will offer higher capabilities and more flexibility, as well as faster production times to meet label buyers’ just-in-time requirements.

Increasing numbers of pressure-sensitive and glue-applied label converters also are producing sleeve labels, paperboard cartons and flexible packaging, as well as the provision of specialist enhancements like augmented reality devices. Across the value chain, merger and acquisition activity has led many companies to consider themselves within the “global” bracket, opening doors to new geographical markets.

Looking to the future

As urban-based populations with greater purchasing power grow larger in the world’s developing regions, all packaging and labeling formats undoubtedly will enjoy an even greater role in brand promotion and product identification.

In all, the paper, film, coating and converting sector has a broad agenda of both challenges and opportunities. Recycling and material reduction, managing imbalances in material supply and demand, a requirement for intensified levels of supply-chain flexibility and the international regulations base – these are all tasks that necessitate greater supply-chain collaboration, along with the outcomes of COVID-19. But, we can be sure that what the label and release-liner industries will deliver, in so many different ways, is a sustainable, robust, growing and essential service for the 21st Century society.

More info: AWA Alexander Watson Associates, +31-20-676-2069, www.awa-bv-com

Ann Hirst-Smith (Herts, UK) is an independent international writer with a career spanning arts and news journalism, book publishing and many years in the pressure-sensitive label industry. Her broad spectrum of professional interests is centered on packaging, printing and graphics, environmental issues and sustainability. Hirst-Smith can be reached at +44-1442-875552, email: ann@hirstsmith.myzen.co.uk.

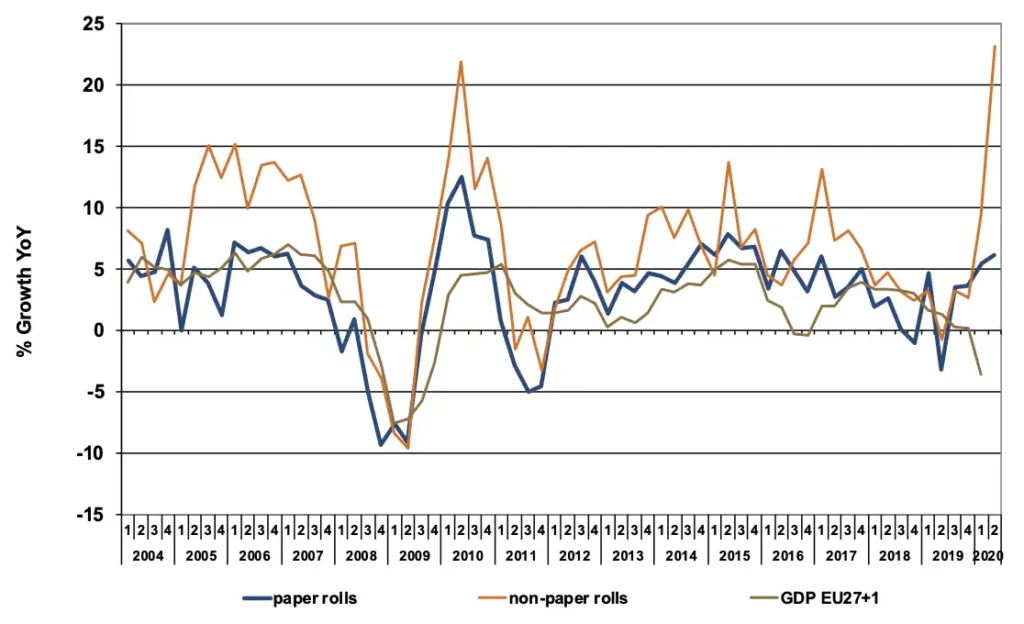

European p-s label industry passes COVID-19 stress test

After two years of modest 1.5% annual demand growth in 2018 and 2019, European demand for pressure-sensitive (p-s) label materials has gotten a boost in the first half of 2020 from – of all things – the COVID-19 pandemic. Consumption of label stock in the wider European economic area was more than 8% above the level recorded in the same period last year. In Q2 alone, demand for roll-film label materials even exceeded Q2 2019 by almost 25%, reports The Hague, The Netherlands-based FINAT (www.finat.com).

The incremental demand increase for label materials in the first half of 2020 was almost 320 million sq meters. More than half of this (53%) was composed of film-label materials (see Figure 6). In relative terms, the most severely affected regions (UK, Ireland and Southern Europe) were behind the other (double-digit) regions but still recorded sizeable increases.

“A tale of fame and famine”

Strong overall demand in January (most likely reaching its peak in the first three months of the pandemic, with the European economy in lockdown) is attributed to the crucial role p-s labels play as enablers of critical infrastructure in times of crisis: food, healthcare, personal-care, sanitary products and supply-chain logistics. This was compounded by stockpiling at retailers and brand-owners, and that households in lockdown spent their spare time on home maintenance and home delivery of goods and services. Finally, with lockdown measures lifted, it’s easy to see how p-s signage plays an important part as “social distancing” markers, FINAT says.

Conversely, label demand in “non-essential” sectors such as automotive, electronics, travel and catering were suffering in the first six months of 2020. The first two sectors also happened to record negative growth last year already compared to 2018, based on preliminary results from FINAT’s bi-annual RADAR Report. “Up until now, 2020 has been a tale of fame and famine for the industry,” says FINAT President Chris Ellison. “Certain parts of the industry could hardly cope with the excessive demand pressures; others had to rapidly adjust to a steep drop in demand in their sector.”

Survival vs. future investment

The fact that, so far in 2020, short-term economic survival has prevailed over longer-term investment was not only apparent in consumer goods and services but also in the label industry’s investment projections. According to the same RADAR Report, label converters are tending to delay investment in heavy equipment until at least 2021.

Another view are the tensions at the operational level in production facilities that, on the one hand, had to cope with excessive demand for labeling and delayed payments from customers, while at the same time deal with disruptions in raw-material supplies and shortages of staff due to COVID-19 restrictions and worker health issues.

Passing the stress test

During the latest online FINAT Briefing, a panel of industry leaders took stock of experiences from the past five months and offered an outlook into the second half of 2020 and beyond the pandemic.

“Our industry has passed the stress test,” says FINAT Board Member Ralf Drache. “In the overheated essential markets of the past few months, label companies have demonstrated their flexibility, resilience and agility. Our industry’s innate ability to respond rapidly to the disruptive circumstances has confirmed its role as a reliable partner, and this will open up new opportunities for more open, collaborative relationships along the supply chain.”

—Edited by Mark A. Spaulding