Pressure-sensitive labels showed the highest growth at 4.9%, while the strong release-liner industry base climbed 4.5% last year and continues to innovate with new end-use applications.

By Corey M. Reardon, president & CEO, AWA Alexander Watson Associates

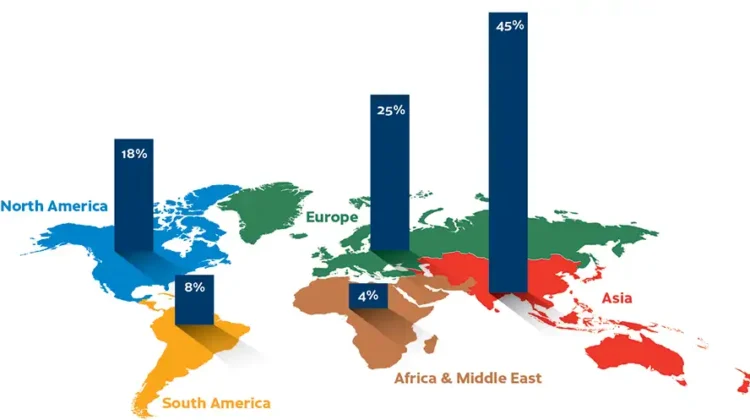

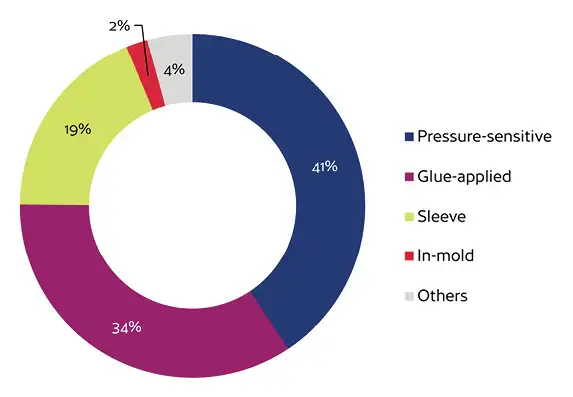

Based on the current publication of AWA’s most recent research, global demand for labels grew by a healthy 3.8% in 2021 over 2020 levels, creating a total volume of 71.01 billion sq meters of converted materials. These volume numbers are spread across several different labeling formats, but primarily pressure-sensitive, glue-applied, sleeve and in-mold labels. It is worth looking at the different labeling formats and technologies, by geographical region, to establish a better understanding of the overall global market, its current status and future trends.

Pressure-sensitive labels stick the landing

In 2021, the pressure-sensitive labeling market grew faster than the overall global label market growth, at 4.9%, and today represents a 41% share of the overall market (see Figure 1). A key application area where it is likely to enjoy continued strong growth is in variable information printing (VIP). In this age of e-commerce, internet retailing and related logistics, VIP labels deliver the product identification and information, key to supporting a safe, efficient and trustworthy supply chain. VIP applications have a 48% share of the p-s label market. In 2021, VIP labels continued to experience growth as consumers realized the convenience and ease of ordering things online. There has been a proliferation of home-delivery platforms catering to this growing consumer demand.

Primary product labeling accounts for 43% of the pressure-sensitive label market – this is primarily in the food, beverage, and health & personal care end-use segments. Worldwide, more private-label product manufacturing, brand versioning (especially short-run label printing using digital technologies) and expanding regional markets all represent continued growth opportunities for p-s labeling.

Where the regional markets stand

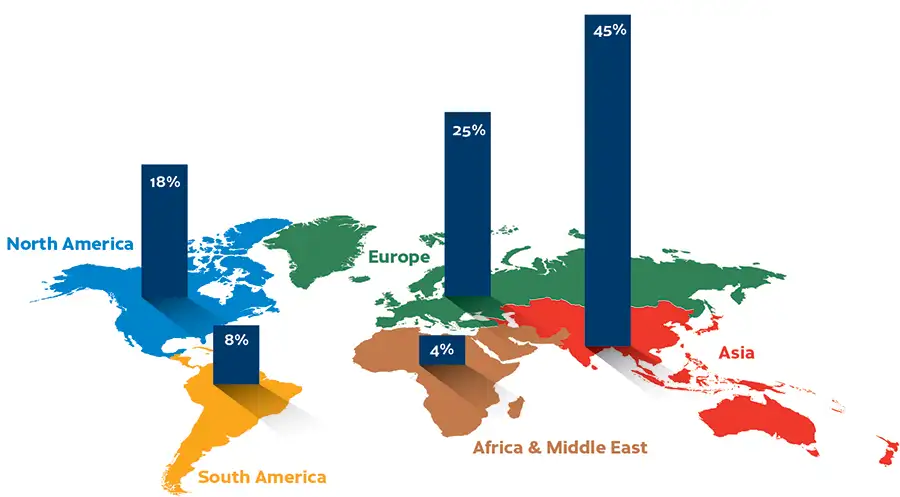

Growth in labeling around the world continues to be driven by Asia, which grew in 2021 at 4.6% and represents a 45% share of the global market (see Figure 2). It remains the region with the highest overall growth opportunities in the coming years, and while growth continues, it does so at a decelerating rate. It also is important to note, across the Asia region, that there are varying market growth characteristics. The region’s current focus on pressure-sensitive, primary product labels for foods and VIP labels for transport and logistics is likely to broaden considerably.

The emerging regional markets of particular interest include Africa and the Middle East, where label demand grew last year by 3.2%. South Africa, Israel, North Africa and the Middle East currently are the main sub-regions with the most dynamic market activities.

As mature markets, North America and Europe managed to achieve 2.8% and 4.2% growth, respectively, in 2021. South America, at 1.6% growth, is recovering slowly from its economic recession over the past several years.

Release liner delivers for new apps

Still dominated by labelstock applications, the other market segments in which release liners are used include hygiene, medical, industrial, envelope, tapes, graphic arts, food & bakery, electronic, building & construction, and composites manufacture – as the recent 2022 AWA Global Release Liner Market Study describes and details. Release liner is a strongly developing industry base which grew at 4.5% in 2021, and it continues to innovate with new applications.

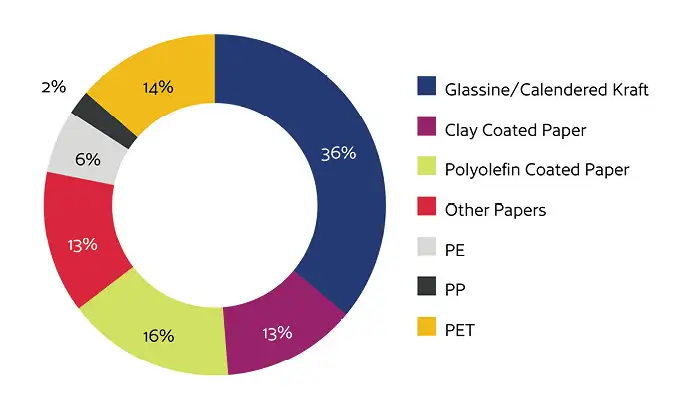

Mainstays of release-liner substrates – glassine and SCK paper – continue to be the highest volume base material, with a 36% share of the global market between them, followed by polyolefin-coated papers, PET-film material and other papers at 16%, 14% and 13%, respectively. Use of PET film as a liner substrate grew slightly in 2021. Asia, currently representing 40% of global release-liner production, remains the fastest-growing region (see Figure 3).

Other key labeling formats

Glue-applied labels: The most mature and established labeling format – glue-applied labels – still claims 34% of world label demand, with moderate growth, driven by the emerging markets. Wraparound labels are growing at a higher rate than cold wet-glue-applied labels in this category.

Sleeve labels: Sleeve labeling technologies continue to be a dynamic product-decoration format, now representing nearly a fifth of all labeling-material volume and offering a choice of formats – heat-shrink TD, stretch, ROSO™ MD, and RFS MD sleeving. In terms of volume, growth, and popularity with brand owners, heat-shrink TD sleeving dominates now with almost nine out of 10 labels in the global sleeving market. It uniquely provides the 75% shrinkage or distortion capability that complex container shapes demand.

In-mold labels: With a very small 2% share of the global labeling market, in-mold labels still are an important labeling format, particularly in certain applications. For brand owners, they offer manufacturing economies and efficiencies without sacrificing product packaging aesthetics; and with expanding consumer markets around the world, they will continue to attract more interest from manufacturers of spreads, ice cream, yogurts and similar high-volume consumer food & drink products.

With a market growth last year at 3.3%, Europe is the largest regional market for in-mold labels, but the highest-percentage growth rate actually was seen in South America and Asia – although from a lower volume base.

Conclusion

The paper, film, coating and converting sector has both challenges and opportunities. These include recycling and material reduction; managing imbalances in material supply and demand; transportation disruptions; and more, not less, regulation – all issues which will involve greater supply-chain collaboration. But one thing is clear: The label and release-liner industries will deliver a sustainable, robust, growing and essential service for the coming decades.

Corey M. Reardon, president and CEO of AWA Alexander Watson Associates (Amsterdam, The Netherlands), is a graduate of the University of Cincinnati in Marketing and Strategic Planning and the Kellogg School of Management at Northwestern University in Industrial Marketing. He began his career over 40 years ago in Corporate Strategic Planning, then joined what today is Loparex in 1987, holding increasingly senior roles in various Product Management, Marketing and Business Development positions worldwide, and Director of Marketing and Sales for European operations. After Loparex, Corey then joined Avery Dennison, as Marketing Director for Europe until he left to acquire AWA in 1999. He can be reached at +31-20-676 2069, email: c.reardon@awa-bv.com, www.awa-bv.com.