By Alison Keane, Esq., CAE, IOM, president and CEO, Flexible Packaging Assn. (FPA)

Introduction

2021 will prove to be as pivotal a year for the flexible packaging industry for some of the same reasons 2020 was. While no one planned on a global pandemic at the beginning of last year, and it will be hard to predict the exact trajectory of the recovery this year, we can say with certainty that the flexible packaging field stepped up to the plate and delivered in more ways than one last year and will continue to do so in 2021.

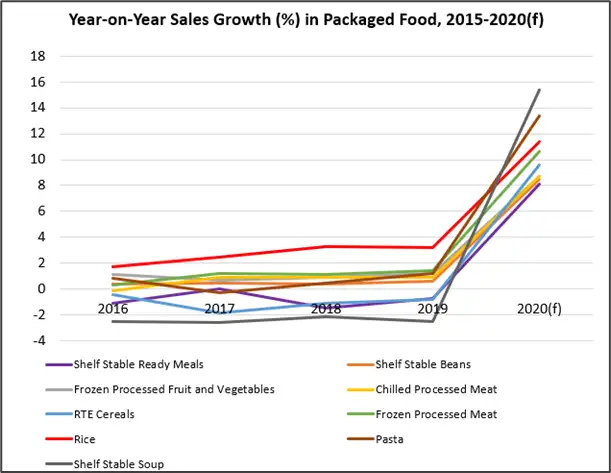

The COVID-19 pandemic changed the way the world shopped and showcased the importance of packaging – and, in some cases, single-use plastics – as consumers were more concerned than ever with the safety and sterility of their everyday products and limited their retail shopping in favor of e-commerce and other delivery methods. A surge in packaged food demand, particularly the “middle of the store,” prepackaged, shelf-stable foods and frozen food sections, was immediate as consumers shifted to at-home cooking and dining (see Figure 1). Consumers stockpiled staples such as toilet paper and paper towels; and, of course, the demand for personal protective equipment like masks, wipes and hand sanitizer skyrocketed.

Even with the already predicted increase in e-commerce, expectations were shattered as consumers shifted to shopping from home. Many states and local governments suspended or postponed shopping-bag bans amid fears that reusable bags were not as sanitary. Sales of take-out bags, single-use cutlery and packaging for meals-to-go blossomed as restaurant dining was closed or severely limited. Legislation targeting packaging and packaged goods for collection, transportation and ultimately recycling also was suspended as states and the federal government shifted to COVID-19 response.

Where do we go from here?

It’s too early to tell how, when and if consumer shopping and buying habits will go back to normal or what the “new normal” will be. However, we know with certainty that legislation impacting packaging and packaging waste will be back this year and with a heightened intensity given the budget deficits facing states and local government, which generally are in charge of municipal solid waste. In fact, despite the COVID-19 pause where state houses adjourned early or went virtual with little or no policy work, by the end of 2020 three states – Maryland, Washington and Oregon – had draft extended producer responsibility (EPR) legislation, while the sponsor of “end-of-life” packaging legislation that failed in California last year indicated that he would refile it.

The COVID-19 pause, however, did give industry time to formulate a more proactive approach to the issue instead of merely reacting to the bad public policy that we saw, such as the California bills. With this lens, the entire supply chain will work on packaging circularity in 2021 and hope to put in place policy drivers that enable the right packaging for the product and an equal opportunity for all packaging types to get collected and recycled.

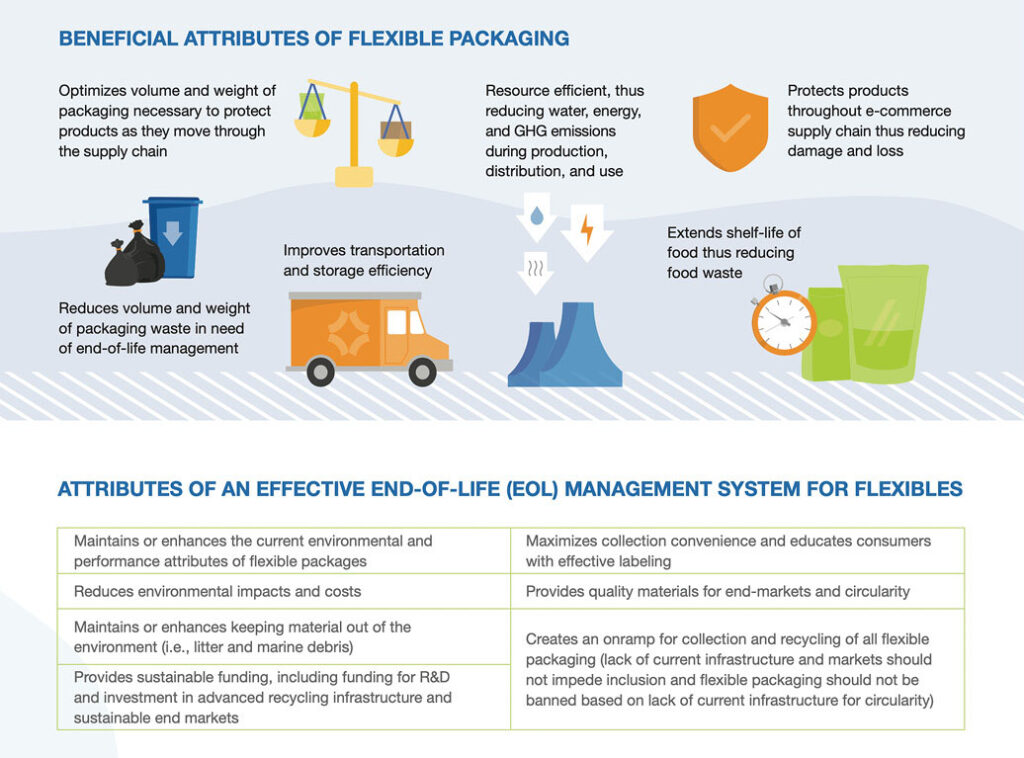

Managing for a circular life

FPA’s converter members – in the unique situation whereby their packaging generally is the most sustainable format from a greenhouse-gas-emission, water- and energy-usage, and material-to-product standpoint – have limited collection and recycling opportunities. Thus, FPA embarked on a year-long dialogue with the Product Stewardship Institute, which represents state and local government solid-waste officials, to discuss the current and future state for flexible packaging in a circular environment. The dialogue resulted in FPA’s Flexible Packaging Circular Life Management Position statement (see Figure 2).

FPA wanted to ensure that the benefits of flexible packaging were acknowledged and to continue to amplify this message to ensure that packaging bans or “de facto” bans, like the ones that would have happened in California if its legislation had passed, would not continue. Instead, FPA membership and the PSI membership came to consensus on numerous important elements of any “end-of-life” management for packaging legislation that would enable an “on ramp” for flexible packaging within a holistic packaging EPR scheme. The full factsheet and elements documents can be found at www.flexpack.org/end-of-packaging-life.

Facing challenges on multiple fronts

With these elements in mind, FPA also has been involved in multiple other dialogues on the topic. FPA became a member of The Recycling Partnership (TRP) and its Circular Economy Accelerator, which is working on federal and state legislation to ensure a circular economy for packaging, including flexibles. TRP now houses the Material Recovery for the Future (MRFF) project as well. MRFF successfully piloted an ongoing program in Pennsylvania in 2020, where flexible packaging is mechanically sorted and recycled through curbside collection along with other more traditional recyclables. TRP will work to ensure other recyclers benefit from the pilot while also working on end-market development for the resulting bale of flexible packaging made through the sorting process.

We also are longtime associates of AMERIPEN and involved in its work on viable financing mechanisms for packaging-recycling infrastructure and support. In addition, FPA joined a year-long dialogue with similarly situated packaging supply-chain associations in the Recycling Leadership Council (RLC), spearheaded by the Consumer Brands Assn. The RLC developed a blueprint for the US recycling system, including three primary policy areas of focus: 1) Data Collection and Reporting Requirements; 2) Systems Standardization and Harmonization; and 3) Development of Financing Tools and Markets. These were included in a White Paper intended for release in Q1 2021.

Mapping out proactive solutions

FPA’s goal is to be part of a proactive solution to packaging circularity and to protect flexible packaging now and into the future. To this end, FPA released its “A Flexible Packaging Path to a Circular Economy: Flexible Packaging Sustainability Roadmap,” which explores the future of sustainability and flexible packaging through 2030. It provides information, knowledge and insights related to flexible packaging and sustainability, circular economy, legislative trends, impacts to the industry along with key outcomes and actions to enable the industry to align with circular-economy principles where packaging materials are collected, sorted, processed and turned back into new products or packaging. Roadmaps for each of the key areas of design, collection, sortation, reprocessing infrastructure and end markets are detailed, with activities that the entire supply chain can undertake either individually or collectively. The report can be found at www.flexpack.org/resources/sustainability-resources.

FPA’s 2020 “State of the Industry” (SOI) reports that flexible packaging remains as a steady 19% of the packaging market in the US, in second place after corrugated paperboard. The industry is worth $33.6 billion with a compound annual growth rate of 3.8% – all this prior to COVID-19. Food, including pet food, and beverages make up 66% of the market for flexibles, or $22.3 billion. Personal-care products equate to 6% or $2 billion.

Market segments for each of these categories are projected for growth in 2021, in most cases by double digits. Again, these projections are pre-pandemic, and while some market segments such as institutional food & beverage were negatively impacted by restrictions on everyday life and consumer’s new shopping habits, most segments saw increased demand and growth, insulating overall industry growth projections against decreases. The COVID-19 pause also insulated the industry from potential bad policy drivers to the circular economy. The pressure is on, however, in 2021 to continue to engage the entire supply chain in promotion and education around the need for packaging and proactive solutions to “end-of-life” management for packaging waste.

More info: 410-694-0800, email: fpa@flexpack.org, www.flexpack.org