By Dan Felton and Dani Diehlmann, Flexible Packaging Association (FPA)

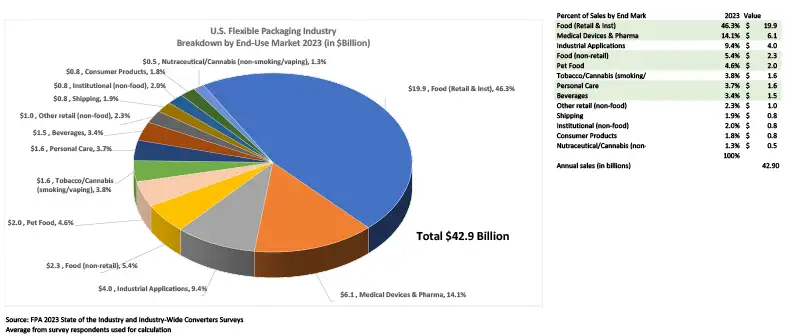

The US flexible packaging industry is estimated to reach $42.9 billion in annual sales in 2023, marking a 3.3% growth from $41.5 billion in 2022. By 2028, the market is expected to expand further to $47.3 billion, representing a compound annual growth rate (CAGR) of 2.0% from 2023 to 2028. Alongside this growth comes increased legislative activity, with the FPA monitoring EPR bills, as well as conversations surrounding circularity, labeling, PFAS and more.

Introduction

In partnership with the economic analysis group Inforum, the Flexible Packaging Association (FPA) conducted a study in 2024 examining the economic impact of the flexible packaging industry, with a focus on 2022 – an unusual year shaped by the ongoing effects of the COVID-19 pandemic. The study revealed that flexible packaging manufacturing directly contributed nearly $41.5 billion to the US Gross Domestic Product (GDP). The industry supports approximately 83,000 jobs, with employees earning $7.3 billion in labor income, an average of $86,600 per worker. Notably, the flexible packaging sector generates more than $500,000 in economic output per worker, approximately 126% higher than the US average of $220,963 per worker (see Figure 1).

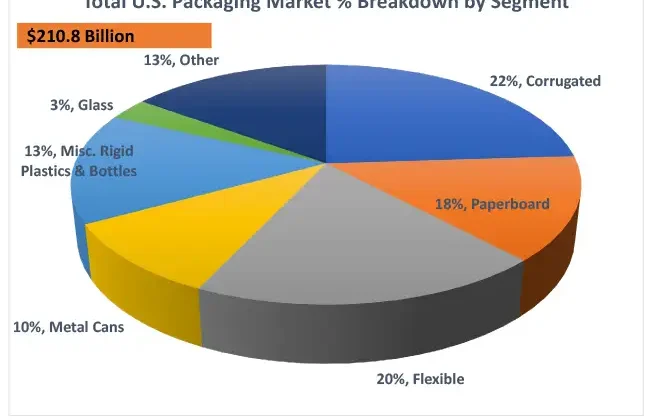

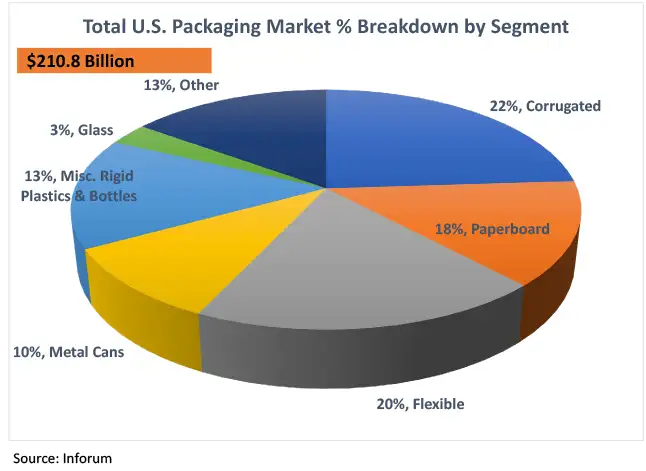

The US flexible packaging industry is estimated to reach $42.9 billion in annual sales in 2023, marking a 3.3% growth from $41.5 billion in 2022. FPA forecasts that the industry will grow to $43.8 billion in 2024, reflecting a more moderate 2.1% increase. By 2028, the market is expected to expand further to $47.3 billion, representing a compound annual growth rate (CAGR) of 2.0% from 2023 to 2028. Flexible packaging continues to hold a significant portion of the US packaging market, representing 20% of the total $210.8 billion market. The only category currently surpassing flexible packaging is corrugated materials, which account for 22% of the market (see Figure 2).

According to an FPA industry survey, while 2023 saw a sales revenue downturn for 58% of survey respondents, a stark contrast to 2022 when 87% reported higher revenue, there is optimism for the future. An encouraging 81% of respondents anticipate revenue growth in 2024, with converters predicting an average growth rate of 3.1% for the upcoming year.

Plastics packaging film; food packaging lead segments

The largest segment within flexible packaging is “Plastics Packaging Film and Sheet (including Laminated) Manufacturing,” which generated $16.4 billion in 2023. This is closely followed by “Plastics Bag and Pouch Manufacturing,” with $15.2 billion in value, and “Paper Bag and Coated and Treated Paper Manufacturing,” contributing $10.7 billion. A smaller segment, related to the use of aluminum foil, accounted for approximately $700 million.

Materials and processes used in flexible packaging vary, with films and resins representing the largest portion of converter material spend. Films make up 51.3% of material purchases, while resins account for 21.9%. Polyethylene (PE) remains the dominant film material, with 95% of converters utilizing it. Polypropylene (PP) and polyester also are frequently used, particularly in food and medical device packaging, where plastic and multi-material packaging offer optimal barrier protection.

Food packaging for retail, institutional and non-retail environments remains the largest end-use market for flexible packaging, contributing $22.2 billion in annual sales, or almost 52% of the market. The medical and pharmaceutical sectors follow closely with $6.1 billion in sales, holding a 14% market share. Other markets, including beverages, non-retail food and personal care, make up smaller portions of the market, with each contributing less than 6% (see Figure 3). Given the specialized nature of many flexible packaging applications, circularity initiatives continue to be a key focus for FPA’s advocacy efforts.

Advocacy at state level includes EPR bills

2024 was another extremely busy year for packaging advocacy at the state level. While FPA was heavily engaged in several issue areas, including labeling standards, recycled content mandates, per- and polyfluoroalkyl substances (PFAS) bans and protecting advanced recycling technologies, our highest priority remained extended producer responsibility (EPR) legislation. At almost the same pace as in 2023, in 2024 we saw 42 packaging EPR bills across 11 states. But only one of those bills, in Minnesota, made it across the finish line – the first new law since 2022. FPA was one of the first trade associations to publicly support the Minnesota legislation as one of the soundest and most producer-friendly packaging EPR proposals we ultimately have seen enacted into law.

States where FPA also was actively engaged in EPR legislation in 2024 but that ultimately failed included New Jersey, New York, Michigan, Tennessee and Washington State. We already know that legislatures in these states, and possibly several others, aggressively will be back at it this year to try to pass their own versions of packaging EPR. We’re cautiously optimistic that at least some of these states will take a more balanced approach like Minnesota, and yet we know others will continue to pursue extremely burdensome and onerous proposals with infeasible material requirements and performance goals that potentially could lead to packaging bans, particularly for flexible plastic packaging. To that end, FPA will continue to be actively engaged on this issue in the states to secure the most favorable outcomes possible for the flexible packaging industry. It is all but impossible at this time of year to accurately predict what states might next pass packaging EPR legislation, but it would not be unreasonable to expect at least two more states to enact related laws between now and the end of 2026.

In 2024, we also actively remained engaged in the ongoing implementation and rulemaking for the packaging EPR laws enacted in Maine and Oregon in 2021 and California and Colorado in 2022. There was significant activity in all these states in 2024, with the laws in Colorado and Oregon set to go into full effect this coming July.

Other legislative targets: recycling, PFAS and labeling

Other bills not directly tied to EPR that FPA focused on included advanced recycling technologies, post-consumer recycled (PCR) content laws, labeling bills and toxic chemical bans, specifically targeting perfluorinated substances (PFAS), polyvinyl chloride (PVC) and polyvinylidene chloride (PVDC) in packaging. FPA, in coalition with others, was successful in defeating or improving legislation in several states (i.e., California, Michigan, New Jersey, Rhode Island) to, at minimum, delay or remove infeasible reporting requirements or bans on the use of PFAS, PVC and PVDC in flexible plastic packaging. We did see success in Rhode Island in 2024 with the passage of legislation to improve the “intentionally added” definition for a previously enacted PFAS law impacting packaging.

Anticipating continued legislature focus on these issues in 2025, FPA will continue to oppose PVC and PVDC restrictions and work to ensure reasonable PFAS thresholds in packaging, make sure bans apply only to intentionally added PFAS and caution lawmakers about a potential materials ban when it comes to PFAS in recycled content.

In 2024, FPA continued to see an increase in the number of recyclability labeling bills introduced at the state level. These “Truth in Labeling” bills are modeled after California’s SB 343 (2021) which targets certain statements and the use of the “chasing arrows symbol” or versions of it. CalRecycle continued to move forward with implementation of SB 343 in 2024 and may finalize its initial material characterization study as soon as February 2025, after which 18 months must pass before the law will fully be in effect.

The clock already is ticking for flexible packaging manufacturers and brand owners to consider whether they might need to make changes to packaging labels, particularly the How2Recycle® store drop-off label for polyethylene structures.

While California could set the precedent for other states to follow, we haven’t seen that happen yet. In 2024, FPA and others successfully amended or defeated bad labeling legislation in Maine, New Hampshire, New Jersey and New York. FPA believes it is vitally important that labeling for recyclability, just like nutritional information and other product communication, be uniform throughout the United States. Labeling based on individual state standards will be devastating to commerce for products people use every day. Further, it will only create more consumer confusion about recycling as people purchase and dispose of goods across state lines.

If you want more recycling, more – not less – harmonization is needed, and these state “one-off” bills do the opposite. In this vein, FPA will continue to urge the Federal Trade Commission (FTC) to update its guidance on labeling for recyclability and work on supporting related Congressional legislation for future introduction.

FPA firmly believes a suite of solutions is necessary to address the lack of collection, processing and end-markets for flexible packaging circularity. We therefore continue to advocate for legislation enabling and funding advanced recycling, including chemical recycling, to be included in that suite. In 2024, Wyoming became the 25th state to adopt legislation ensuring that advanced recycling facilities are regulated as manufacturing rather than solid waste.

Particularly for food and health and medical packaging, advanced recycling likely will become critical to meeting post-consumer recycled (PCR) content mandates. While the flexible packaging scope of such PCR mandates in the US currently applies only to plastic bags in some states (e.g., New Jersey and Washington), we believe we will continue to see legislation proposed in additional states to expand beyond plastics to other forms of flexible packaging. To that end, FPA will continue to be very actively engaged in this issue as well.

Conclusion

Finally, with the new year comes a new federal administration and Congress – both controlled by a single party. It is too early in this new year to know for certain where we may see legislative and regulatory proposals directly or indirectly targeting the flexible packaging industry, but FPA will be watching closely for anything and everything, including taxes and tariffs on our products and processes.

Dan Felton is president and CEO of the Flexible Packaging Association (FPA), and Dani Diehlmann serves as vice president of Communications. They can be reached at 410-694-0800, email: fpa@flexpack.org, www.flexpack.org.