Economic reports for December 2024, almost without exception, were better than expected. Nonfarm payroll employment, from a survey of employers, jumped by 256,000 vs. a consensus forecast of 155,000; that was the biggest increase since March. Civilian employment, from a survey of households, surged 478,000; that also was the biggest increase since March. The unemployment rate, from the same household survey, edged down from 4.2% to 4.1%.

Spending is up

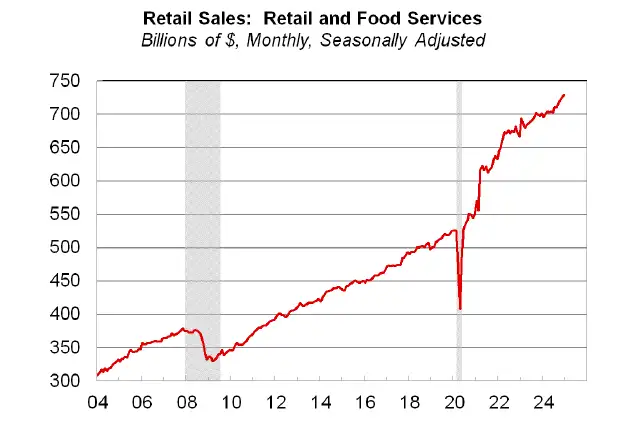

Americans tend to spend when the labor market is strong, and December was no exception to that rule. Headline retail sales rose 0.4%, slightly below the 0.6% consensus forecast (see line graph below), but the “control group” used to calculate the Personal Consumption Expenditures component of Gross Domestic Product rose a very strong 0.7%. The 0.4% increase in December came on top of an upwardly revised 0.8% increase in November. Light vehicles sold at a 16.8 million seasonally adjusted annual rate in December, the highest selling rate since May 2021, when sales were boosted by the pandemic relief checks included in the American Rescue Plan.

Even the beleaguered manufacturing and housing sectors did well in December. Industrial production in US manufacturing rose 0.6%, and November’s increase was revised up from 0.2% to 0.4%. The Institute of Supply Management’s Manufacturing Purchasing Managers Index (PMI), at 49.3, still was below the neutral level of 50, but the production component of the index was above 50 for the first time in six months, and the forward-looking new orders component rose to 52.5, equaling its highest reading since May 2022. (The ISM Services PMI came in at a better-than-expected 54.1, and the Business Activity component, the ISM index with the highest correlation to GDP growth, came in at a robust 58.2.) Building permits for single-family homes rose for a third straight month in December, to their highest level since February. The National Association of Home Builders/Wells Fargo Housing Market Index rose a point in January vs. expectations of a one-point decline.

Inflation is lower than expected

After the run of stronger-than-expected growth reports, the Federal Reserve Bank of Atlanta’s GDPNow “nowcast” is pointing to growth in real GDP at a 3.0% annual rate in the fourth quarter of 2024. The Congressional Budget Office’s estimate of potential growth, the fastest rate of growth that can be sustained without an acceleration in inflation, is about 1.8%.

Despite the stronger-than-expected growth, inflation was lower than expected in December. The headline Producer Price Index rose 0.2% vs. expectations of a 0.4% increase. Excluding food and energy prices, the PPI was unchanged; it was expected to rise 0.2%. The Consumer Price Index rose 0.4% in December, as expected. The “core” CPI, excluding food and energy prices, rose 0.2% vs. expectations of a 0.3% increase. The S&P 500 stock price index rose 1.8% in response to the better-than-expected core CPI report, but this seemed like an overreaction to me. The core CPI increase, 0.23% unrounded, annualizes to 2.7%. Even accounting for the difference between the CPI and the Personal Consumption Expenditures price index favored by the Federal Reserves, this is inconsistent with the Fed’s 2% inflation target. So, while the lower-than-expected inflation report was good, it wasn’t that good.

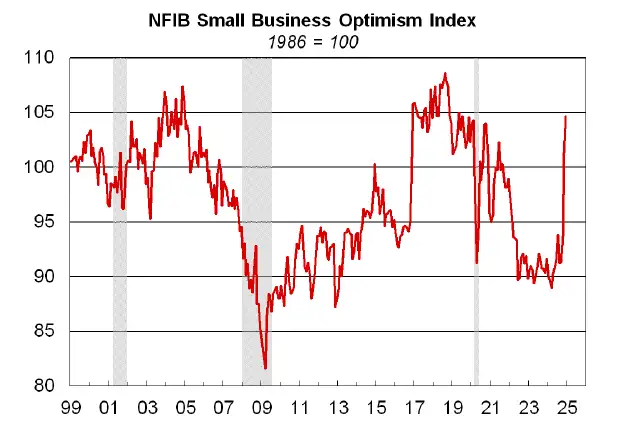

The limited data we have for January suggest that strong growth continues into 2025. Initial claims for unemployment insurance totaled 217,000 in the week ending January 11, closer to 55-year lows than to levels that signal a recession. The general activity index from the Federal Reserve Bank of Philadelphia’s Manufacturing Business Outlook Survey jumped to 44.3 in December, its highest reading since April 2021. It was expected to come in at -6. Forward-looking survey measures suggest that strong growth will continue, at least in the short term. In addition to the ISM new orders index rising above 50, the National Federation of Independent Business’s Small Business Optimism Index, which rose from 93.7 in October to 101.3 in November, rose to 104.7 in December, its highest level since May 2019 (see line above right).

Not all data are good

Not all data are good, especially where inflation is concerned. The spot price of Brent Blend crude oil rose from $72.12/barrel on December 23 to $82.69/barrel on January 13. The (Henry Hub) spot price of natural gas rose from $2.89 per million btu to $4.40 over the same period. Higher oil and gas prices will boost headline inflation in the coming months. If sustained, they also will have a negative impact on growth.

The federal budget deficit was 39.4% higher in the fourth quarter of 2024 than in the fourth quarter of 2023. Outlays were up 11% from a year earlier; receipts were down 2%. Unless the Trump Administration succeeds in cutting government spending, budget deficits will continue to rise as higher interest rates increase financing costs and the extension of the 2017 Trump tax cuts reduces revenue. Larger budget deficits will make it more difficult for the Fed to achieve its 2% inflation target. So will higher tariffs, albeit temporarily.

Persistently above-trend growth and inflation that still are above the Fed’s target and at risk of rising this year have weakened the case for further cuts in the Fed’s federal funds rate target. The better-than-expected inflation reports last week moved the next rate cut expected by futures markets from September to June but left the number of expected rate cuts in 2025 at one. I also expect just one cut, but I think it will come later in the year.

Those who are counting on multiple rate cuts to boost stock prices or lift home sales and housing starts out of the doldrums are likely to be disappointed. Above-trend growth, stubborn inflation and larger budget deficits already have pushed up long-term interest rates. The yield on 10-year Treasury notes rose from 3.63% on September 16 to 4.79% on January 13 before turning down last week.

Uncertainty for 2025

While the US economy has significant short-term momentum, uncertainty about the economic outlook increases as we look further into the future. That uncertainty is driven by uncertainty about the size and breadth of tariffs to be imposed by President Trump, by uncertainty about the extent of retaliation by our trading partners, and by uncertainty about how much of the burden of tariffs will be borne by US consumers and how much by foreign producers. (It isn’t as simple a question as both the proponents and opponents of tariffs think it is.) We also don’t know how interest rates will react to bigger deficits.

For the last 44 years, budget deficits have failed to lift interest rates as much as economists expected. As a result, economists have been likened to The Boy Who Cried Wolf. But, like the wolf in Aesop’s fable, the bill for the lunch that seemed to be free eventually will come.

Robert C. Fry, Jr., Ph.D.

Chief Economist, Robert Fry Economics LLC

302-743-8553

RobertFryEconomics@gmail.com, www.linkedin.com/in/robertcfryjr