By Daniel J. Cahalane, president/CEO, American Roller & Plasma Coatings

The industry, the end-user and the roll supplier all have a hand in leaving opportunities for manufacturing improvement on the production floor. From faster machine speeds to improved quality, companies’ roller fleet utilization and management are being neglected by users and suppliers. In this paper, we highlight the lack of specifications in many applications and detail how to correct this. We also highlight the lack of metrics in roll use and what actions can be taken to rectify this. We conclude by highlighting many of the misnomers within the industry supply chain, which drive inconsistency in products and services delivered.

The industry challenge and why

In web-processing rollers, the areas of roller utilization, best practices, maintenance and fleet management have significant opportunity for process improvement. In too many of these areas, we (the industry) are sloppy with details and lack metrics to document performance and continuous improvement. We are leaving process improvement and economic value on the surface of the roller.

Why do we allow this to happen? In many cases, roller spend is a lower amount in the overall maintenance, repair and operations (MRO) spend within a plant. As a result, plant operations or executive management tend to focus on other aspects of the business or what they perceive as higher impact areas. Ironically, web-processing rollers typically are the piece of equipment affecting machine speeds and quality. Therefore, just because they may be lower spends, they can be the highest impact component in production and quality metrics. This often is overlooked.

What are the contributing factors, and what can we do about it? There are three groups of “offenders” all leaving value on the surface of the roller: the industry, the end-user and the supplier base. In the following article, we will highlight these areas of inefficiency and identify root cause and corrective action.

The Industry

Within the industry, there are two themes that many view as acceptable – or feel the time and effort required to correct is not important. They are: (1) lack of roller specifications and (2) what we call “The Con Game.” These industry problems result in inefficiency and lost economic opportunity.

Lack of specification: In a majority of the web-processing industries, end-users do not have a master specification file of what they have/want per roll position. As a result, they don’t know what they receive from suppliers and do not have anything to validate it against. Oftentimes, the business process is sloppy: Rollers ship to suppliers without documentation, POs often read “make it like last time” and core journal repairs are subjective. At any given time, 30% of in-house rolls from end-users do not have purchase orders or tracking information. The lack of clear specifications and sloppy paperwork cultivates a mindset of being loose with the details which directly correlates to performance issues. This culture breeds the second theme.

The Con Game: Many roller suppliers are smaller operations (fewer than 20 people) and, as a result, face struggles with critical-mass challenges in running a business. These struggles often show up in two areas: (1) materials being supplied and (2) tolerances being achieved. Small suppliers often must substitute material specified since they do not have the material in stock. They also may ignore the roller tolerance because of capability limitations. In some cases, suppliers will even “re-cap” instead of recovering customers’ rolls to save costs.

How are we sure this is happening? In working with end-users to solve problems and enhance performance, we find that in 30% of the cases we analyze the material, durometers and tolerances they thought they were getting were not correct.

How does this happen? This happens because the end-user often has no measuring standard (or the resources) to inspect incoming rollers, they do not require certified supplier-quality sheets, and they do not go back and audit or verify supplier compliance.

- What can a roller end-user do to correct this?

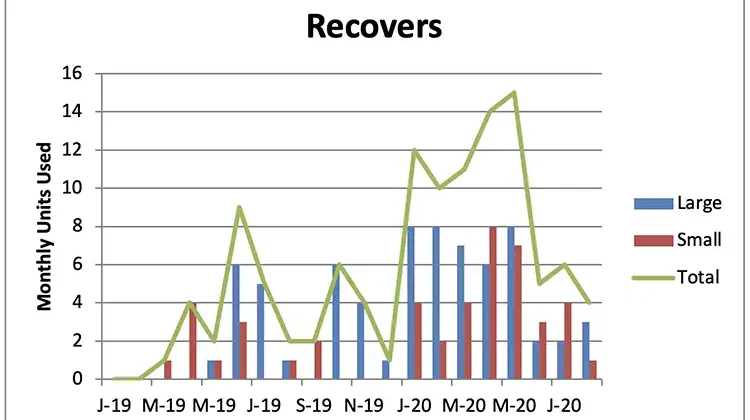

- Document a master specification file for every roller position (see Figure 1).

- Develop formal master service agreements with suppliers.

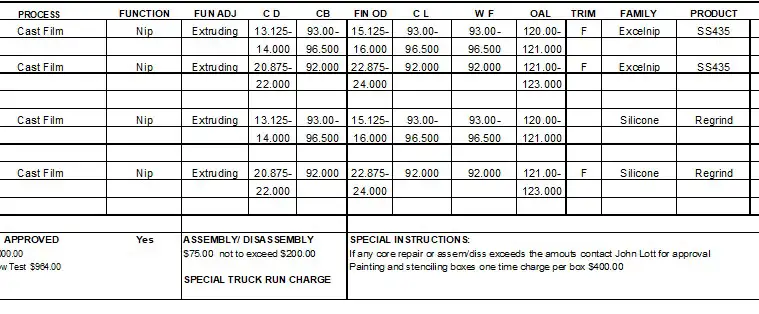

- Require suppliers to provide usage metrics; certified quality documentation (i.e., laser profiles, proof & accountability documentation) (see Figure 2).

- Audit the supplier.

The End-User

The dataset that drives observations and conclusions regarding end-user-based inefficiencies ranges from single plant entities to global multinational plants. There are three identified groupings, and the degree at which end-users struggle in these areas is wide-ranging. Further, the same plant can have different levels of success or challenges within these three groups:

Decentralized vs. centralized decision-making: Almost all end-users address roller spends in a decentralized plant mindset. Some end-users have tried corporate initiatives with virtually no success as local plants resist, citing several real factors such as differences in equipment and local servicing needs. Most examples of these initiatives center on a unit price, purchasing-consolidation perspective. The market as it exists today is highly unit-price competitive, and efforts in this regard have yielded poor results. However, very few organizations have approached it from an application or roll-position perspective, based on standardization of materials and tolerance requirements. Our company has experienced end-user success with a very narrow set of companies that recognize this opportunity and put programs in place to drive results led by a corporate engineering department.

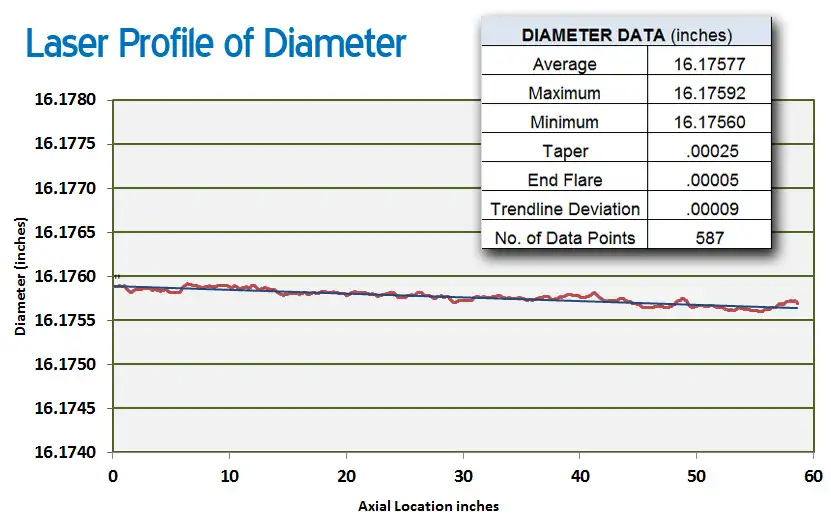

Generalist and poor metrics: Many end-user plants have been downsized, and personnel have become more generalized; therefore, they are not roller experts. As a result, personnel often make poor roller business decisions due to a lack of knowledge, training or time. While many plants have computerized maintenance management systems (CMMS), these systems often are not used for roller metrics to drive continuous improvement and uncover untapped opportunities. Very few end-users generate quarterly metrics around roller use, performance and the correlation to spends and overall machine performance (see Figure 3). In addition, very few end-users have measurable process-improvement objectives around rollers as they do not have the baseline data from which to work.

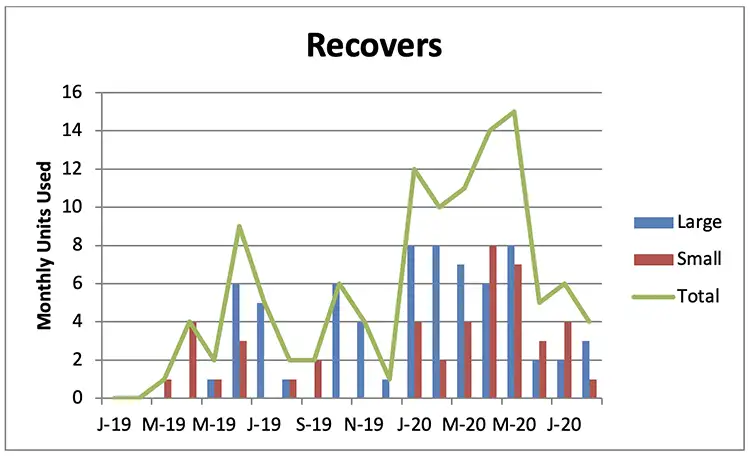

Unit Price vs. value delivered: Within the web-processing industries, there is a mix of business – about 50% commodity oriented and 50% high-value-added applications. A unit-price perspective in the commodity arena is a reasonable expectation. However, in value-added applications, roller performance directly relates to improved run-time, fewer quality defects or lower total cost of ownership (TCO) on a machine (see Figure 4). Value is measured by these parameters as opposed to unit price. However, almost all end-users view web-processing rollers as commodities and are unit-price-focused. All rollers are lumped into one commodity category. This means end-users miss vital opportunities to improve their operations.

What can a roller end-user do to correct this?

- Evaluate and decide your level of centralized or decentralized strategy.

- Are you purchasing or application-engineering driven in your approach?

- Does your company or plant use a CMMS? Do you have access to roller metrics?

- Do you have quarterly use and performance metrics as it relates to machine performance? Do you have a continuous improvement program in this area?

- Are you using your supplier base as a technical consultant? To help with best practices?

- Have you segmented your roller needs? Unit Price vs. Value Added. Can you quantify?

Supplier Base

It probably is no surprise that to the supplier base, we have room to improve and be better. We have our own three areas where we could assist the industry and the end-user in unlocking economic value in web-processing rollers.

Niche product offerings: To effectively drive value, all types of roller constructions and coverings need to be considered when developing value-based solutions. Rubber coverings are not the answer for every application, and the same can be said for urethane or hard-facing coverings. This presents a challenge for end-users who already struggle at times with their depth of knowledge and limited time to research multiple suppliers. The supplier base often does not have a well-rounded expertise in all the technologies available.

Suppliers are decentralized: Most suppliers are a single facility, which makes them centralized by nature. Almost all of the other multi-plant roller companies approach the market and manage internally in a decentralized way. This presents a challenge to end-users who have developed or would like to implement some level of corporate standards and need a supplier base that can help in that execution.

End-users need consolidated suppliers: The roller industry today has more supply than demand. As a result, there is extreme price pressure on suppliers to cut costs. This by itself isn’t necessarily all bad, but as a result only a very small handful of companies are investing in R&D efforts or future technology. Even the “larger” suppliers, who do pursue R&D, are increasingly devoting more resources to project execution to make up for the knowledge gap at the end-user customer level. Smaller suppliers continue to cut corners – focusing on the “unit price” chase.

What can a roller end-user do to correct this?

- Evaluate your supplier base to understand what niches you are getting advice from.

- Be sure you have evaluated all options of roller technology for your applications.

- Dig deep and fully understand what your suppliers do in-house vs. outsourced.

- Evaluate how your centralized vs. decentralized strategy correlates to what you expect of your supplier base.

Conclusion

The claims, observations, data and viewpoints of this paper are based on over 85+ years of involvement in the web-processing industries. Data is derived based on doing business (on an annual basis) with over 1,300 different web-processing manufacturers. This includes processing over 23,000 unique purchase orders and more than 360,000 rollers annually in 23 different market segments.

There are exceptions within the industry to the items highlighted in this paper; however, they are just that – exceptions – and not general practice as observed and documented by data. There are exceptions, but be careful not to fall into the mindset trap of “but my company is different.”

Dan Cahalane, president/CEO of American Roller and Plasma Coatings (Union Grove, WI) holds a Bachelor of Science in Electrical Engineering from Marquette University. He has been with the company since 2005 and in manufacturing for more than 25 years. Previous to American Roller, Dan held global management positions at ABB, a large international automation group. He is a member of the Board of Directors for the Metropolitan Milwaukee Assn. of Commerce (MMAC) and is managing director of Cahalane Investments LLC, which invests in private middle-market manufacturing companies. Dan can be reached at 262-878-7281, email: Dan.cahalane@americanroller.com or www.americanroller.com.