Flexible, thin-film printed batteries; strong electric-vehicle demand;

solid-state technologies; and Li-ion battery recycling are key trends.

Edited by Editor-in-Chief Mark Spaulding

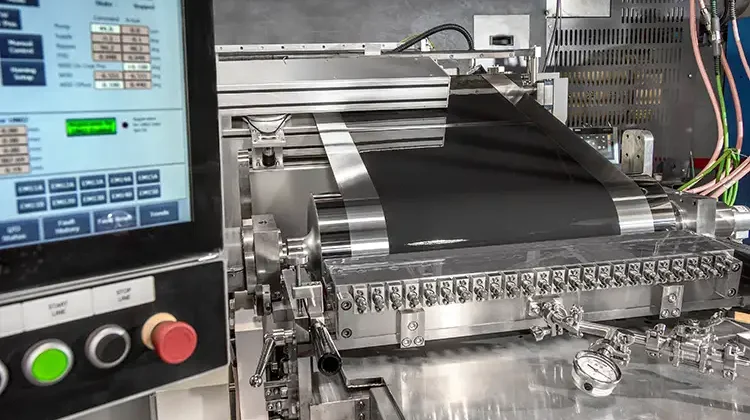

![Slot-die coating of electrode slurry on aluminum foil against a backing roll. (Photo courtesy of Dürr Megtec [www.durr-megtec.com]).](https://convertingquarterly.com/wp-content/uploads/2025/02/cq221_coveroption.webp)

Whether taking the form of high-powered lithium-ion (Li-ion) cells for electric vehicles, thin flexible laminations for trendy fitness wearables or traditional cylindrical Coppertops, batteries are experiencing enormous innovation and investment worldwide. The 1,500-GWh market demand forecasted in 2030 by IDTechEx Research indicates huge potential for batteries no matter their application.

Converters, material and component suppliers, and research centers around the globe have made significant progress in the past decade toward manufacturing batteries to be lighter, stronger, cheaper, safer and faster-charging. Their work falls into a handful of key areas: thin-film printed batteries, solid-state technologies, high-performance Li-ion cells, electric-vehicle end-uses, and battery recycling & materials recovery.

Rollable, bendable batteries

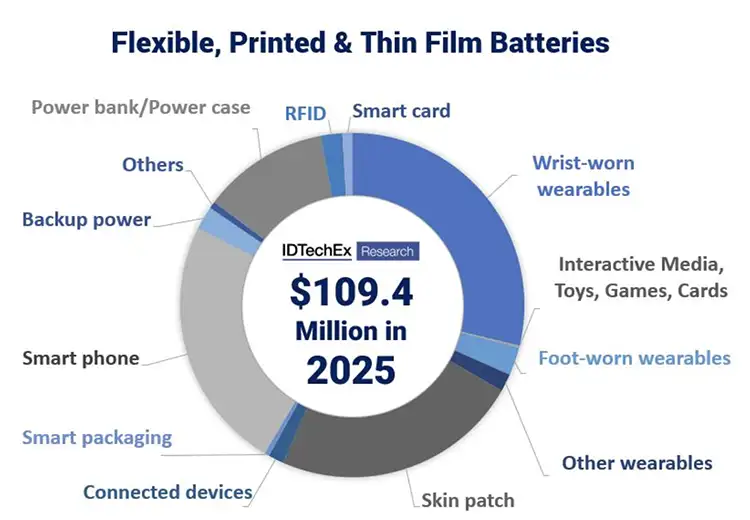

The breakthrough field of thin-film, flexible and printed batteries has been struggling for a long time. Applications are mainly targeting consumer devices, and they are in the relatively early stages of adoption due to higher costs, unestablished supply chains and developing technologies. Still, IDTechEx Research predicts the global market will reach $109.4 million in 2025 and top $500 million in 2030 (see Figure 1).

Now, this area is seeing a transition from technology push to market pull. Driven by significant reductions in battery thickness and weight, new rollable/bendable forms and converting processes using mainly printing methods, these batteries are seeing demands from new markets such as smart cards, backup power, smart packaging, toys/games/greeting cards, cosmetics, medical skin patches and RFIDs.

On one hand, the technology approaches for printed batteries have been more mature, with available methods delivering predictable performance. This means the individual technology category has its specification range and suitable markets with both its capabilities and limitations. On the other hand, IDTechEx Research says, the successful development of these end-use markets requires the final piece – power sources – and thin-film battery makers are answering the call for new kinds of power solutions. By extension then, the successful players in this sector are highly involved with final product development as well. The key for thin, flexible and printed batteries to succeed is to target correct applications, based on the capabilities and limitations of the battery.

EV-battery bottlenecks need solutions

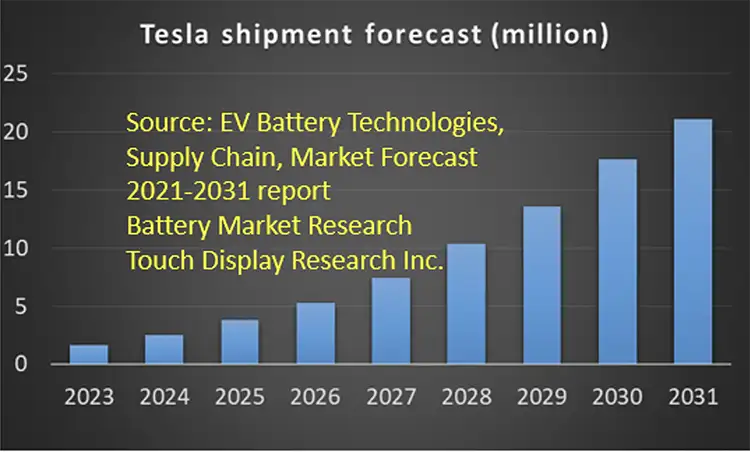

Electric vehicles (EV) likely are the largest end-use battery market with the greatest potential over the next decade. EVs will make up 52% of all new cars and trucks by 2031, says Dr. Jennifer K. Colegrove, CEO and principal analyst of Battery Market Research and Touch Display Research, Inc. To achieve this fast growth, batteries are the most critical component, but at the same time battery capacity, cost and safety are the three-pronged bottleneck for the mass adoption of electric vehicles. It’s almost a Catch-22 situation, but Colegrove is confident EV batteries will create billion-dollar opportunities in the next 10 years.

Tesla currently is the most valuable automotive company. In its “EV Battery 2021 Report,” Battery Market Research forecasts that Tesla will ship 10 million vehicles in 2028 and reach 21 million by 2031 (see Figure 2). To achieve the fast growth of electric vehicles, Tesla will add four more battery factories with new battery technologies in the next several years.

EV batteries can be made into cylinders, prisms and pouches, explains Colegrove. From battery cell to module to pack, many factors and steps must be carefully designed and automatically managed. As with flexible and printed batteries, EV energy sources often are end-use or vehicle-specific to satisfy detailed demands, such as energy density by weight, energy density by volume, charging characteristics, operational temperature, safety, cost and toxicity.

A shift to solid-state technology

Since their commercialization back in 1991, Li-ion batteries have achieved worldwide success. However, this cannot hide their intrinsic limitations in terms of safety, performance, form factor and costs, says IDTechEx Research. Consequently, electric vehicles are expected to include solid-state batteries as an innovative solution to market demands to 2030.

Most current Li-ion technologies employ liquid electrolyte, with lithium salts in an organic solvent. However, the solid electrolyte interface limits the effective conductance rate. Furthermore, liquid electrolyte needs expensive membranes to separate the cathode and anode, as well as an impermeable casing to avoid leakage. Current high-end Li-ion batteries can reach an energy density of over 700 Wh/L at the cell level, with a maximum driving range of about 300 miles for electric vehicles. Improved high-nickel-cathode materials may further push the energy density.

Solid-state electrolyte, conversely, enables integration of better-performing materials such as lithium metal and high-voltage cathode materials. In this case, solid-state batteries will provide greater value. As both the electrodes and the electrolyte are solid-state, the solid electrolyte also behaves as the separator, allowing volume and weight reduction. This provides for a more compact arrangement of cells in the battery pack by using a bipolar setup, which in turn enables higher voltage and capacity at the cell level.

In addition, the removal of flammable liquid electrolytes can be an avenue for safer, long-lasting batteries as they are more resistant to changes in temperature and physical damage during use, IDTechEx says. Solid-state batteries can handle more charge/discharge cycles before degradation, promising a longer lifetime. Better safety means less safety monitoring electronics in the battery modules and packs. And, high energy-density lithium-metal anodes can further push the energy density beyond 1,000 Wh/L. All in all, these features can further make solid-state batteries a game changer.

The importance of Li-ion battery recycling

Despite the impact of the COVID-19 pandemic, substantial volumes of Li-ion batteries soon will be reaching their end-of-life. A new IDTechEx report estimates that 330,000 tonnes of waste Li-ion batteries were generated in 2020. The majority of this came from consumer electronics. However, it is the sheer volume of end-of-life EV batteries which will be problematic if not properly dealt with; still there are several factors which suggest the recycling and resource-recovery markets will grow to meet this requirement.

The large EV markets of Europe and the United States are increasingly concerned with the implications of relying on foreign (Chinese) raw-material and battery supplies and are actively seeking to develop a domestic supply of critical materials, including those present in Li-ion batteries. While the US is home to some key material resources, such as graphite and lithium, Europe is resource-poor. Recycling of manufacturing scrap or end-of-life batteries therefore could be a key resource allowing for some diversification of supply.

Answering the call is Canada-based Li-Cycle Corp., reportedly the largest Li-ion battery recycler in North America. Li-Cycle announced in April 2021 that it will build its third commercial recycling facility, to be located in the Phoenix (AZ) area. When complete, Li-Cycle’s facility will process up to 10,000 tonnes of end-of-life batteries and battery-manufacturing scrap per year, thus bringing its total recycling capacity to 20,000 tonnes/yr.

The “Spokes™3” facility will convert battery waste and end-of-life batteries into intermediate products, such as “black mass” – a powder which contains a variety of metals, including lithium, cobalt and nickel. Li-Cycle’s future site in Rochester (NY) will process the “black mass” through a hydrometallurgical circuit to produce critical, battery-grade materials, including lithium carbonate, cobalt sulphate and nickel sulphate, as well as other recycled materials that can be returned to the economy.

More info: www.idtechex.com/research, www.TouchDisplayResearch.com