Annual survey of TLMI converter members finds that majority have seen

business volume, employee hires increase over the course of the pandemic.

The North American label industry has proven itself remarkably resilient in the face of the COVID-19 pandemic, according to a new report by market research firm and consultancy LPC, Inc., carried out on behalf of TLMI.

The recently published Spring Edition of the TLMI Market Watch report represents a comprehensive survey of TLMI member converters divided into four categories depending on annual sales. These include smaller companies with annual sales under US$6 million (22% of the sample); the $6 million to $15 million annual sales category (33% of the sample); $15 to $35 million (25%); and the large converter and converter groups with over $35 million in annual sales (20%).

The introduction to the report paints the story of the greatest recession in nearly a century, as overall consumer spending in 2020 plummeted in Q2 and Q3 of the year in the face of lockdowns and stay-at-home mandates. However, the demand for labels and printed packaging surged in most end-use segments, while others experienced disruption and historically low demand in the first half of last year. These under-performing segments now are showing signs of recovery as markets open back up.

One of the report’s headline figures is that sales revenues increased for 72% of surveyed TLMI converting companies, while 19% reported sales declines. For those companies whose business volumes increased, 23% reported robust sales growth of more than 15% for the first three quarters of 2020 compared to the same period a year earlier, while 13% of survey participants reported sales were up by more than 20%.

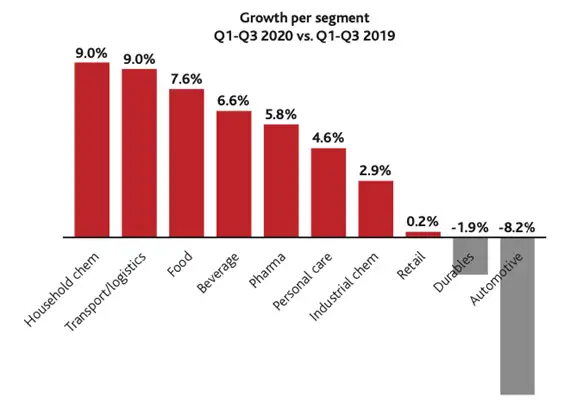

A common growth denominator for converters was the surges in the food, select beverage and household-chemicals segments, while those companies at the lower end of the growth spectrum more often than not served the segments which experienced steep downturns – entertainment and hospitality, automotive and durables (see Figure 1). Aggregated average growth rates varied significantly across end-use segments, with converters serving the highest-growth sector (household chemicals) reporting a 17% average growth-rate difference compared to the sector that performed the poorest (the automotive space).

Where to now?

Given that the pandemic has created such a skewed economy, what are the prospects for North American label converters as the economy slowly unwinds from COVID-19 restrictions?

For the hardest-hit sector (automotive), the Automobile Manufacturers Assn. estimates it will take at least until 2024 before lot sales return to pre-pandemic levels. However, 2019 production levels are likely to be reached by the end of this year or in early 2022 as automobile companies rebuild inventories to compensate for 2020 factory shutdowns. This suggests a rebound for converters serving this sector given how integral pressure-sensitive labels are in the automobile-components production process.

And while many consumers still are pushing back big purchases, once stores fully reopen across North America, economists project that the demand for consumer durables will pick back up and even surge in some segments due to pent-up demand.

Employee impact

The pandemic very quickly divided workforces into three categories: work-from-home; “essential” employees who continued to perform critical functions on the production floor; and those employees who either were furloughed or laid off.

The TLMI Market Watch survey shows that only 11% of converters were forced to lay off employees last year. Nearly half of participating companies reported their employee numbers remained the same, and 40% of participants actually had to hire new personnel to keep up with surging demand.

In addition, almost 70% of the survey sample indicated that they raised pay and/or awarded their employees bonuses in 2020. Large companies (>$35 million) were twice as likely to give bonuses compared to medium-sized converters in the $6 to $35 million annual sales category. The survey found that most label industry employees now are reporting back to work rather than working from home, reflecting companies’ now-proven ability to keep their workforces safe onsite and on active production floors.

Conventional and digital production

The report makes for some interesting reading regarding the current installed press base in North America as well as converters’ future capital-equipment purchasing plans.

A key finding is that 8% of surveyed companies are digital-only facilities with no conventional presses. On the flip side, one quarter of the survey sample currently do not have a digital press on their production floor, while half the sample has only one or two digital machines (Note: Digital presses in the report are defined as machine systems costing $450,000 or more, to differentiate from the tabletop and/or desktop class of digital systems that print labels).

Digital print in 2020 accounted for one quarter of converters’ aggregated revenues, which represents a considerable jump in the two years since the last Market Watch survey was published, when digital accounted for just 17% of participating converters’ revenues. Despite the increasing penetration of digital print, however, conventional still remains by far the most widely employed category across the North American market.

The pandemic certainly gave a boost to digital production with the surges in rush-driven ordering, and digital sales for converters grew by an average of 15% in the first three quarters of 2020. Conventional press sales also received a boost for more than half of survey respondents. The 20% of participating converters who indicated that conventional-press business was down over the same time period were primarily in the mid- to medium-size company scale categories and mostly serve the year’s laggard segments, such as durables, industrial chemicals and automotive.

Converters that saw high levels of growth during the pandemic have found their conventional-press capacity under pressure due to order surges in medium- to longer-run segments. This could well explain why, for the first time in half a decade, more TLMI converters said they will buy a conventional press than the number indicating that they would purchase a digital press in the coming year. This marks a first for the TLMI Market Watch, which up to now always has put digital in the lead when it comes to unit purchasing projections.

One of the final questions in the Market Watch Converter Survey asked converters what other packaging materials they convert alongside p-s labels. Along with a predictable increase in shrink sleeves, an unexpected finding is a rise in folding-carton manufacturing. At the same time, companies previously converting film products (wraparound non-shrink labels, lidding and sachets) have moved into more traditional flexible-packaging applications (standup pouches, bags, etc.).

Supply-chain challenges

The label and packaging markets have, and continue to, experience severe supply-chain volatility across virtually all aspects of print-production supplies and consumables. Inks, coatings, substrates (both film and paper), cleaning supplies, empty containers and most other materials used in day-to-day production either are in short supply, unable to be shipped, increasing in price or a combination of all three. Add to this situation a “perfect storm” regarding global shipping and delivery challenges, and we have a supply-chain scenario unlike anything any of us have previously witnessed.

We asked a few TLMI member converters for their input on the current situation and how it’s affecting their companies. Here’s what they had to say:

No big surprises…impacts are to prices and lead times. Both are increasing since the beginning of the year. Regardless of components, every supplier mentions the same inputs driving these impacts: Raw-material supply shortages within the context of increasing demand; transportation capacity and costs; and a few others have included labor and general overhead increases specific to their need to raise prices.

Price increases are somewhat predictable after so many years of relative stability, but the lead times have been the most challenging.

Certain raw-material shortages have led some suppliers to discontinue products, sometimes abruptly, and that creates another host of headaches trying to introduce alternatives to customers, particularly in the pharma space where change never happens quickly.

Every day seems to bring a new headache and stretching our human resources. We’ve sometimes had personnel from purchasing to finance to compliance to sales all devoting entire days to resolving whatever the issue of the week might be, and then only to have another one crop up the next!

Similar impact to resin supply and costs are what I’ve heard referenced most commonly by our customers. I’ve also heard about supply challenges with glass, lumber, certain metals and corrugated. I haven’t talked to a customer yet that hasn’t experienced inflationary and lead-time pressures in almost everything they buy. You can sense a real weariness and grudging acceptance whenever we must mention a price increase or

order delay.

Most suppliers have implemented “no new customer” rules and are reviewing abnormally large orders.

Freight is a mess – longer time in the lane, lost freight and higher level of damage.

What steps should a prudent label-converting company take? First and foremost, if converters are not speaking with their major suppliers on a regular basis, they must start doing so now. Communication is key in this current market dynamic – so companies know what they can realistically expect, and so suppliers know their anticipated needs and can plan accordingly.

We all understand the reasoning and benefits from lumping purchases with a few key suppliers, but if there ever was a time to move beyond single sourcing and just-in-time deliveries, it’s now; companies should consider adding secondary and even tertiary vendors for critical materials and consumables and divert enough business to them in the months ahead to receive some priority status. Converters also should consider increasing inventory where and when they can – without panic buying or hoarding.

Conclusion

Some final thoughts from current TLMI Chairman Lori Campbell, president of The Label Printers: “What has occurred most to me in this year is that this should be waking all of us (suppliers, converters and end users) up to the weaknesses in our business continuity plans. COVID-19 put in motion many of the drivers leading to present-day supply-chain challenges, with some weather disasters pushing them over the edge. The impacts should have been more widely predictable…despite the over-use of ‘unprecedented’ to describe them.”

More info: TLMI at 513-401-9042, www.tlmi.com