Sleeves, in-mold labels, new release-liner base stocks to help converters address

key brand-owner, consumer requirements for a post-COVID-19 world.

By Ingrid Leering, publishing & subscription supervisor, AWA Alexander Watson Associates

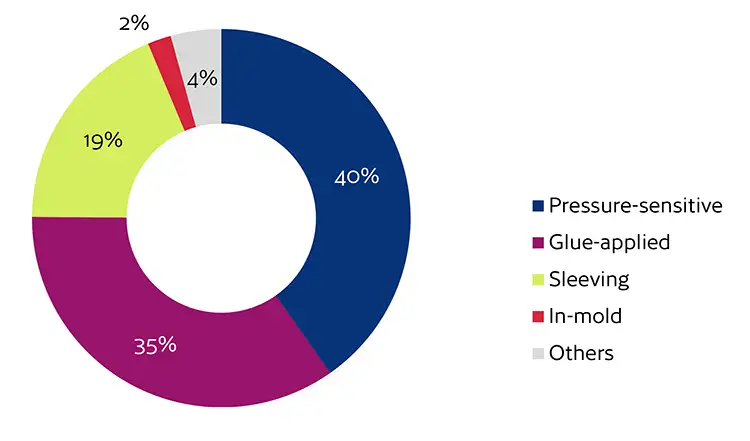

Based on publication of AWA’s most recent research, global demand for labels grew by a healthy 3.3% in 2020 over 2019 levels, creating a total production volume of 68.379 million sq meters of materials. These volume numbers are spread across several different labeling formats, but primarily pressure-sensitive and glue-applied labels, sleeve labels and in-mold labels. It is worth looking at the different labeling formats and technologies, by geographical region, to establish a better understanding of the global market, its current status and key future needs to maintain a healthy industry worldwide.

Pressure-sensitive labels

In 2020, the pressure-sensitive labeling market grew slightly faster than the overall global label market growth (at 3.9%), and today represents a 40% share of the overall market (see Figure 1). A key application area where it is likely to enjoy continued strong growth is in variable information printing (VIP). In this age of e-commerce, internet retailing and related logistics, VIP labels deliver the product identification and information key to supporting a safe, efficient and trustworthy supply chain. With nearly half of the total p-s label market, VIP applications are where we can expect to see even higher growth due to the COVID-19 pandemic, lockdowns and continued growth and use of e-commerce and internet shopping – well beyond post-COVID-19.

In primary product labeling, pressure-sensitive labels represent a 44% share; this is primarily in the food, beverage, health and personal-care product end-use segments. Worldwide, more private-label product manufacturing, brand versioning (especially short-run label printing using digital technologies) and expanding regional markets all represent continued growth opportunities for p-s labeling.

Status of regional markets

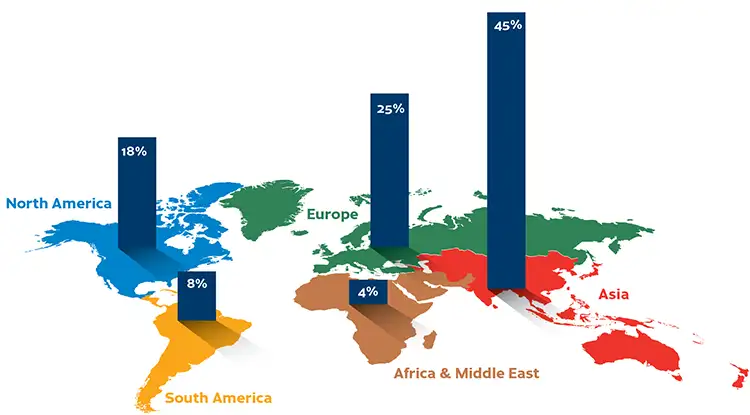

Growth in labeling around the world continues to be driven by demand in Asia, which grew in 2020 at 4.0% and represents a 45% share of the global market (see Figure 2). It remains the regional market with the highest overall growth opportunities down the road and, while growth continues, it is slowing down. Still, it’s also important to note, across the Asia region, there are varying market-growth characteristics. The region’s current focus on pressure-sensitive, primary-product labels for foods, and VIP labels for transport and logistics is likely to broaden considerably.

Emerging regional markets of interest include Africa and the Middle East, which grew last year by 3.1%. South Africa, Israel, North Africa and the Middle East currently are the main sub-regions with the most dynamic market activities.

The mature markets of North America and Europe managed to achieve 3.0% and 2.8% growth, respectively, last year. South America, at 1.6%, is at last recovering slowly from its regional economic crises.

Release liners

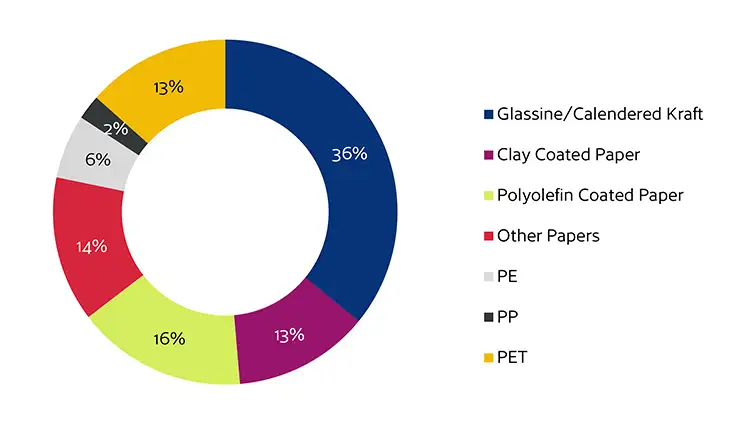

Still dominated by label-stock lamination applications, other market segments in which release liners are used include hygiene, medical and pharmaceutical, industrial, envelope, tapes, graphic-arts, food and bakery, electronic, building and construction, and composites manufacturing – as the recent 2021 AWA Global Release Liner Market Study covers in detail. Release liner is a strongly developing industry base, which grew at 2.7% in 2020, and continues to innovate with new applications.

Glassine and super-calendered kraft (SCK) paper remain the high-volume, release-liner base materials (see Figure 3), with a 36% share of the global market between them. This is followed by polyolefin-coated paper, other papers and PET film material at 16%, 14% and 13% shares, respectively.

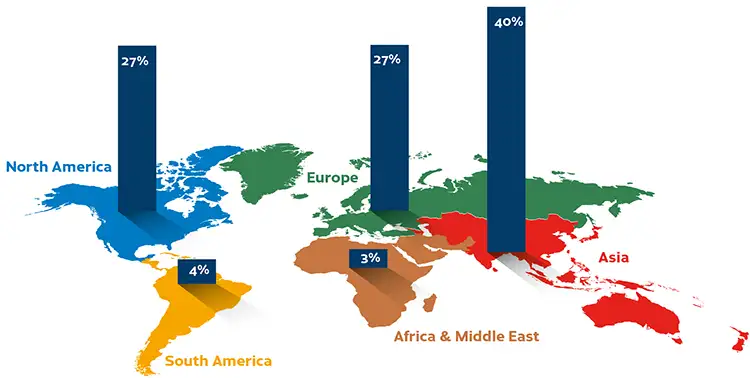

Asia, currently representing 40% of the global release-liner production market, remains the fastest-growing region (see Figure 4). North American and European output of liner materials remained unchanged from 2019 with 27% share each last year.

A closer look at different labeling formats

Glue-applied labels: As the most mature and established labeling format, glue-applied labels still claim 35% of world label demand, with moderate growth, driven by emerging geographical markets. Wraparound labels, however, are growing at a higher rate than cold wet-glue labels.

Sleeve labels: Sleeve labeling technologies continue to be a dynamic product-decoration format, now representing 19% of global labeling volumes and offering a choice of formats – heat-shrink TD, stretch, ROSO™ MD and RFS MD sleeving. In terms of volume, growth and popularity with brand owners, heat-shrink TD sleeving is the most successful, now with 89% of the global sleeving market. It uniquely provides the 75% shrinkage or distortion capability that complex container shapes demand – particularly in today’s fast-growing market for “on-the-go” drinks and snacks in contoured plastic containers. Such applications are delivering, for brand owners, a much-expanded opportunity for decoration, enabling “head-to-toe” brand identity and the optional added element of package security in “over-the-cap” applications. To simplify recycling of such plastic containers, many heat-shrink sleeve labels today are perforated, so consumers may separate them from the container before discarding.

In-mold labels: Still with a very small share of the global labeling market at just 2%, in-mold labels are an important labeling format, particularly in certain application categories. For brand owners, they offer manufacturing economies and efficiencies without sacrificing product-packaging aesthetics. And with expanding consumer markets around the world, they will continue to attract more interest from the manufacturers of spreads, ice cream, yogurt and similar high-volume, consumer food-and-drink products. Europe is the largest regional market for in-mold labels, with a market growth last year at 3.0%, but the highest percentage growth rate was seen in South America and Asia – although from a lower volume base.

Complementary trends for the years ahead

Flexible packaging: Flex packs also will continue to bring change to the retail shelf – either direct-printed, replacing the need for a label, or in some cases, with separately printed labels. Changes in the size of packaging to accommodate single-use as well as large-quantity content are an element that is adding strength to this market.

Emerging labeling technology: Direct-to-container print – on plastic, glass and metal containers – is a developing technology which offers added options in terms of limited editioning and personalization, and also is an important area for digital printing. AWA research indicates that the health and personal-care and household-chemical product sectors are the most likely end-use markets to be early adopters for this technology.

Sustainability: Recycling and sustainability are top concerns in every industry, and an increasing number of related international legislation now is being directed toward labeling and packaging. Downgauging of label and packaging substrates, and focusing on mono-materials as opposed to multilayer structures, already are evident. Pressure-sensitive and shrink-sleeve labeling are additionally faced with concerns over waste creation at the label production and application stages. P-s labeling’s volumes of “by-product” – compared to the broader packaging industry – are relatively small, but complex. The mixed nature of a pressure-sensitive label (clean adhesive-coated label laminate, printed/diecut laminate, matrix waste, silicone-coated release liner) is driving the development of industry-specific recycling. Today, collection and recycling/second-life solutions, covering label converter and label application sites, are successfully functioning in many countries – good news because high-quality, release-liner base stock is entirely suited to second-life uses.

Conversely, shrink-sleeves are not necessarily compatible for recycling with the containers to which they are applied, but here again there is positive movement. Perforated shrink-sleeves, which the consumer may “unzip” after use to simplify recycling, are available, and developments in fully recyclable sleeving film are coming on-stream.

Looking to the future

What then are the growth trends for the future?

Pressure-sensitive labeling’s versatility will keep it healthy, and industry initiatives on sustainability and recycling of associated byproducts will continue. VIP labels will certainly be a growth driver, while primary product labeling will continue to experience competition from other labeling technologies. However, in primary product labeling, developments in private-label products for retail and brand versioning (especially for short-run label print using digital technologies) represent continued growth opportunities.

Digital printing has introduced new possibilities – shorter print runs for brand versioning or local-language labels, as well as for specific brand identities and personalization. To meet this widening range of label and product-decoration options, analog print processes, particularly flexography, now are increasingly – and very successfully – partnering with digital print via hybrid presses from several different manufacturers.

Conclusion

In all, the paper, film, coating and converting sector has a broad agenda of both challenges and opportunities. Recycling and material reduction; managing imbalances in material supply and demand; a requirement for intensified levels of supply-chain flexibility and the international regulations base – these are all tasks which will necessarily involve greater supply-chain collaboration, along with the outcomes of COVID-19. But we can be sure that what the label and release-liner industries will deliver, in so many different ways, is a sustainable, robust, growing and essential service for 21st century society.

Ingrid Leering, publishing & subscription supervisor at AWA Alexander Watson Associates (Amsterdam, The Netherlands), can be reached at +31-20-676-2069, email: [email protected] or www.awa-bv.com.